There are many different credit cards perks out there. I think we always hear about travel perks, such as travel delay, auto insurance, or many others. One benefit of some cards is matching the price of a product if it drops after you purchased it. An underrated and extremely easy one I have been able to use is Citi Rewind.

My Experience with Citi Rewind

What is Citi Rewind?

Citi offers a perk to all of their cards, which doesn’t seem to get much spot light. It could actually be one of their more valuable ones, especially if you use one of their cards frequently.

Citi Rewind monitors the price of an item you purchased for 60 days. If the price drops, Citi will send you a check, or credit your account the difference. Other credit card companies have a similar benefit, but you are responsible for doing the leg work.

If you are feeling ambitious, Citi does have a form you can fill out if you choose to look on your own. If they are willing to do the work for you, why would you?

How do you file your claim?

After you log into Citi Rewind, you’ll be asked to search for your product. I have seen lots of products in these searches, but not every product available is in their database.

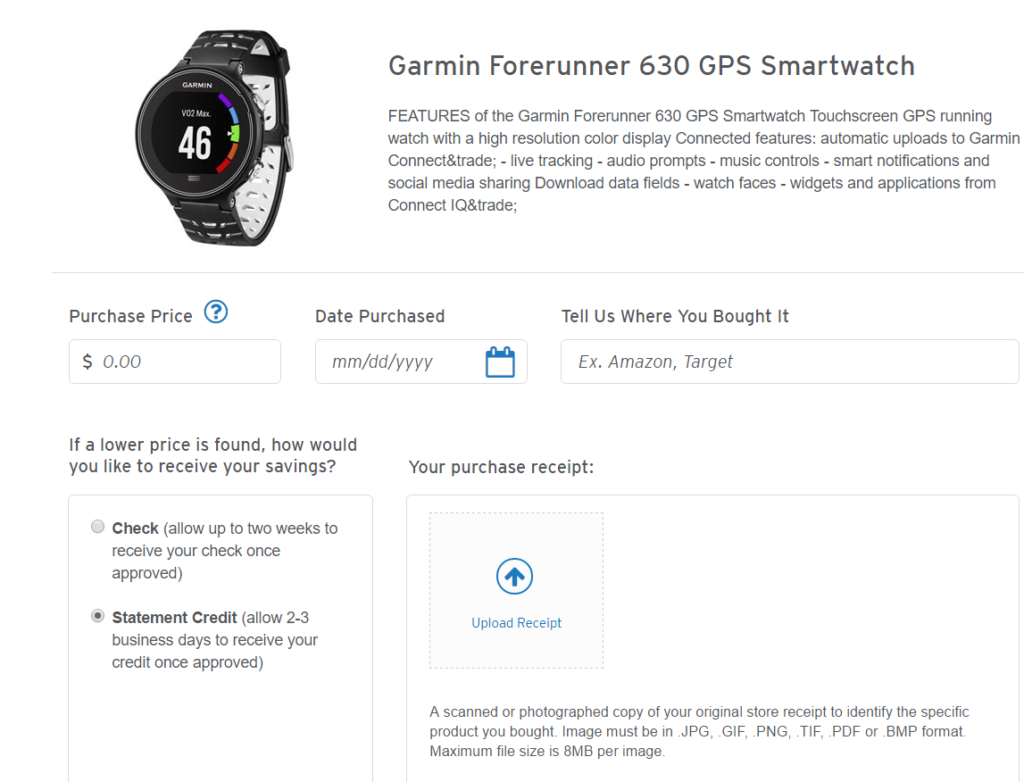

After you search for your product, you will have some information to fill in. I have noticed on some electronics, there are multiple options. Some of these ask for different model numbers, so be aware of that information.

The information you will need is:

- The price you paid

- The date you purchased the product. Your search is from 60 days of purchase, so you can register a product if you forgot about it.

- Where you purchased the item

- Upload a receipt. This can be from an email or taking a picture from your phone and uploading it.

- How you’d like to receive your refund, if Citi finds a lower price

Once you enter all that information, you are finished. Citi takes over and looks for a better price.

Waiting for a better price:

I have noticed that the updating of prices usually lags a few days. It isn’t anything to be concerned about, but if you are impatient (like I am) it could bother you.

If you do realize there is a better price that Citi did not find. There is a form you can fill out and fax to them. Why you can’t fill it out and email it baffles me. Maybe since it is more work, they thing people won’t follow through? Hopefully they update their system to allow for electronic submission of a better price.

When your claim is being tracked, Citi has a great graph showing you their results:

As I mentioned previously, these aren’t updated in real time. Citi does notify you if there is a lower price found.

If a better price is found, the refund is not instant. You must wait until the end of the 60 days before Citi will issue a refund.

Receiving your refund:

This is pretty straight forward. If you select a credit to you account, it takes a couple of days after the Rewind closes.

The limit on refunds is up to $500 per claim and up to $2,500 per year.

If you select the check option, Citi does say it can up to 2 weeks for you to receive your check.

Either option is acceptable, but if you are wanting your refund sooner, then you should definitely select credit.

My Personal Experience with Citi Rewind:

I have used Citi Rewind 3 times. If I could commit to using just a few cards, then this could actually be a higher number of Rewinds. I try to tell myself to stop opening cards and use the ones I have, but the big bonuses keep pulling me in!

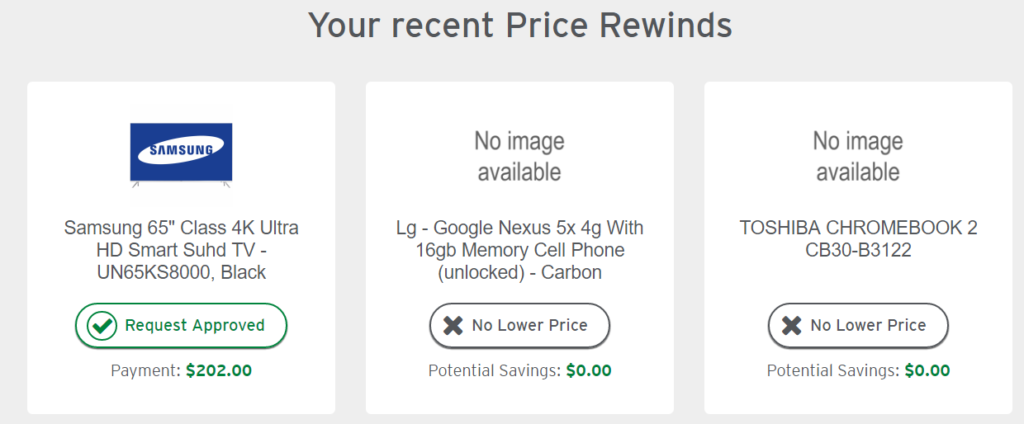

The times I have used Citi Rewind, they have been for electronics. Out of the 3 times I have used Citi Rewind, I have received only 1 refund. The one refund was well worth it.

You can see I struck out twice, but on the TV I purchased, I received a refund that made up for the others. Or there’s the possibility I do solid research when I purchase something, I find the lowest price 🙂 .

The Argument for Fewer Points

I am someone who loves to maximize my point earnings. If I am not working on a bonus, I am using the highest reward earning card.

There could be the argument to bypass some rewards for the ability to save some serious money on certain items. For non-bonus spend, I have been shifting more to cash back instead of points.

Let’s take the TV I bought as an example.

Now I bought that Samsung TV at Best Buy for $1699.99 and used the Ibotta App for 2% cash back. I did use some Amex Offers to buy some gift cards to lower my cost as well ( I saved about $50 more using those offers). To compare the potential savings against points, let think of it this way.

If there was a 5x card to use at that time, like the Chase Freedom (there wasn’t, but stay with me), I would have earned 8495 in Ultimate Reward points points, plus $33.98 in cash back from the Ibotta App. I would peg Ultimate Reward points around 1.8 cents, that would be about $150 in rewards, plus the cash back from the Ibotta app. Totaling about $184. Which isn’t bad, if that option was available.

Using my Citi Double Cash, I earned about $34 in cash back, plus about $34 in rewards from the Ibotta App. With this method you “only earned” $68. Which is slightly more more than one third when compared with the option above.

Now add in the $202 I received back as a refund from Citi, now my total cash back was about $270. Which was about 46% more than the potential value of 5x points.

That is a decision you would have to make. Is forgoing extra points worth the potential of earning money back on items? I would think for large ticket items, yes, but that is just me. On smaller ticket items, probably not.

Conclusion:

Citi Rewind is a great benefit that you can just “set and forget.” It could definitely be one of the more underrated benefits of Citi credit cards.

It is very easy to fill out the forms necessary to get your claim rolling and there is no downside here. Especially when there is a lot of potential for earning money back. If you don’t receive a credit, then you spent 10 minutes filling out a form.

Have you ever used Citi Rewind? Did you save any money?

Don’t forget to Like me on Facebook, or Follow me on Twitter. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!

I’ve started to switch to Citi whenever I purchase electronics. They have a good extended warranty (on paper) 24 months after the manufacture warranty expires PLUS the PriceRewind benefit. I’ve been able to get $800 back this past year in rewinds.

Hey JZT,

That’s a lot of money! Rewind is definitely a great perk and the extended warranty is great as well!

Thanks for reading! I appreciate it!

Dustin

used it frequently. you can absolutely email it to the email address on the form.

if you are filing an email claim, you’ll have to disable to the automatic price rewind.

Hey JL,

Good to know! Thank for the tip!

Thanks for reading! I appreciate it!

Dustin

“I did use some Amex Offers to buy some gift cards to lower my cost as well”

I don’t understand this part of your post. Are you implying that Citi provides this feature regardless of how payment is made, and that you don’t have to use their card to be covered? For an extreme case, let’s say you bought this TV for $1705. You purchased $1700 of gift cards using an Amex, then used those $1700 GC plus $5 on your citi double rewards card to pay for it. If the price subsequently went down from $1705 to $1500, would Citi send you $205?

Or less extreme, you buy $1500 in GC, pay for it with those $1500 plus $205 on the citi DR card. Will they refund you $205 after the price goes down?

Hey Mark,

Per Citi’s Rewind FAQ:

Yes, you must pay for the item at least in part with your Citi card. We will only pay the lesser of the actual amount paid for with your Citi card or the maximum coverage per item.

As long as you put a partial payment on it, you are eligible, but it seems to be it would max out at the amount put on your CC. I’m not sure if people have gotten around that or not though.

In your first example, based in Citi T&C you would only be eligible for $5. On example 2, yes you could have the full $205 credited if that were to happen.

Thanks for reading! I appreciate it!

Dustin

@JL (and anyone else),

The manual form says the ad should include the effective date of sale, which is almost never part of an online price display. What do you do for this piece?

I just got an email from Citi advising me that they found a lower price on my daughter’s prom dress so I will be getting $137 back!

@tro For the manual form, I usually print the online ad or add the item to my basket and print that with the date header showing. All my manual requests have been approved that way.

Hey Denise,

That’s great! The Rewind feature is very convenient! I hope more companies do something similar for their customers. It is definitely an underrated benefit.

Thanks for reading! I appreciate it!

Dustin

Okay thats all good but citi cards are so hard to be approved for thete appear to go pass good credit scores of 680 + and look more for excellent credit scores why ? Thanks

Hey Trinette,

If you are looking to play the points and miles game, you should wait until your credit score is 700 or more. Although 680 is close, I would still wait. There are banks who will let you play with a score of 680.

Thanks for reading! I appreciate it!

Dustin