This offer has expired

Last month, I wrote about how the terms had changed on many Chase cards to allow customers to earn the bonuses again as long as it had been 24 months since the last time they received the bonus.

One of the cards I had listed was for a more inferior Marriott link of 40,000 points and a $150 statement credit. With an existing 70K offer, 40K does not really cause a lot of excitement. However, the existing 70,000 point offer had the language in the terms that excluded applicants from receiving the bonus if they had already received it.

Application Link – Chase Marriott Card 70,000 Points After $2,000 Spend (I do not receive a commission for this link)

Today, I received a limited-time offer that is also for 70,000 points but you need to spend $2,000 in 3 months instead of the $1,000 the other 70K offer requires. Not that big of a deal, really, when you consider that you can actually get this offer, as long as it has been 24 months since you last received it. This is the Marriott Rewards Premier Chase card.

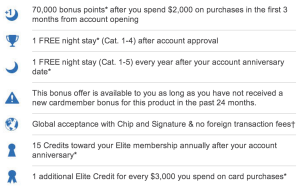

Here is the exact language from the application:

This bonus offer is available to you as long as you have not received a new cardmember bonus for this product in the past 24 months.

This is great news as 70,000 Marriott points is a really nice score! Here is what you get with this offer:

- 70,000 bonus points after spending $2,000 in the first 90 days

- 1 FREE night Category 1 – 4 after account approval

- 1 FREE night Category 1 – 5 every year after your account anniversary

- 15 credits towards your Elite membership annually after your account anniversary (free Silver status)

- 1 additional elite credit for every $3,000 spent

- Annual fee ($85) waived the first year

Summary

Do not be confused – there are two Marriott cards that offer 70,000 points. Only one of them (this one) allows previous cardmembers to apply and receive the bonus again. The other offer is only for new cardmembers. You can tell the difference by the spend requirement – this offer requires $2,000 in 3 months and the other offer requires $1,000 in 3 months.

What can I spend the 70000 points on?

It can be spent on anything from 9 nights in a Category 1 (can receive more free nights by staying 5 nights in a row and getting the 5th night free) to 1 night at a Category 9 and still having enough left over for 1 night at a Category 5. In addition, it could also be a great start towards a Hotel + Air package that would give you 7 nights and 50,000 miles in an airline program. The cost for that is 200,000 points. Lot of options!

Average award night cost is 20 – 30k points?

If I currently have this card and received the bonus >24 months ago, can I still apply and get the bonus? If I need to cancel my current card to get the 2nd bonus, I lose the anniversary free night on my current card.

Also, on the related FT thread, people say that Marriott (not Chase) keeps track of credit cardholders, so they will not issue you the signup free night if you have had the card in the past 5 years. If this still holds true, you may not get the free night from Marriott.

You should be fine. Since the language of the card offer says to not have received the bonus in the last 24 months, you should also be able to keep the card open that you have now. It does not say that you must have closed a current card.

I signed up for the first offer 2 months ago, $1000 spend. So when can I sign up for the churnable offer?

Since it is the same product, you would have to wait another 22 months. 🙁 Stinks, but hopefully the language will remain the same or there will be a product change!

The application link you have above for 70,000 points with $2,000 in spend does not have 24 month language.

It says: Replying to this offer: If you omit any information on the form, we may deny your request for an account. Chase cardmembers who currently have or have had a Chase credit card in any Rewards Program associated with this offer or have received a similar bonus offer, may not be eligible for a second Chase credit card in the same Rewards Program, or for any bonus offer.

Do you have a link to the have not had the card in past 24 months for 70K?

That is strange – the e-mail definitely said the 24 month part as part of the bulleted info. I will load a photo of that in the post for reference. Since it is not a landing page, the e-mail probably counted as the “landing” page.

Which would you recommend if you are just starting out and have not had either?

If you are just starting out, I would go for the one with the smaller spend (the $1,000 spend requirement). They are the same card and bonus except for the ability to get another (with the higher spend offer). To not have to put another $1,000 on the card makes the $1,000 spend card my pick for you.

I saw the T&C from The Frugal Travel Guys website and it states that current cardholders are not eligible. Have there been any confirmations of cards being granted to current cardholders?

According to the terms, that is correct – no to current cardholders. But, you could cancel your current card today and apply for the other one tomorrow and be eligible (providing it has been 24 months since you received the sign-up bonus).

[…] after $2K spend. There are specific situations where the $2K spend offer may be better (details here) so I added this offer below the other one, but for the most part $1K spend is better than […]