This offer has EXPIRED and the current offer is for 50,000 Avios

One of the largest bonuses in the miles and points industry is the occasional offer from the British Airways from Chase. The card normally offers 50,000 Avios as the sign-up bonus but when they receive the increased bonus, that amount is increased to 100,000 Avios after meeting spending requirements!

Application Link – British Airways Avios Credit Card from Chase – up to 100,000 Avios bonus

Bonus Structure

The requirements to earn the full bonus are some pretty hefty spending! Here is how the bonus structure breaks down:

- 50,000 Avios after spending $2,000 in the first 3 months of card membership

- 25,000 Avios after spending $10,000 in the first year of card membership

- 25,000 Avios after spending an additional $10,000 in the first year of card membership

- Total: 100,000 Avios after spending $20,000 in the first year

That is some serious spending! One of the good things about that type of spending, however, is that you will receive a minimum of another 22,000 Avios because of the spending. This will make for a total of 125,000 Avios.

Here are some of the highlights about the card:

- Not eligible if you have already received a bonus with this card

- The annual fee is $95 and not waived the first year

- No foreign transaction fees

- Issued by Chase

- Receive a companion ticket if you spend $30,000 on this card in a calendar year

Spending Avios

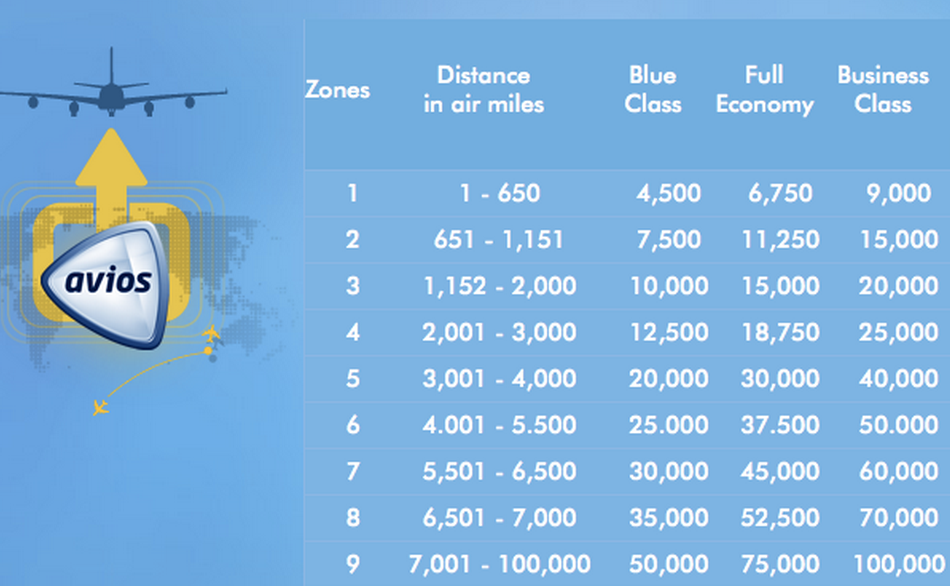

Avios are a distance based airline currency. This means that you will get the most benefit out of them if they are used for short-haul flights and/or flights that are non-stop (each segment is charged as part of the whole award).

To give an example of the difference between booking a trip with distance-based British Airways Avios and zone-based American Airlines miles, look at these numbers that would have been required for my trip in January on the New York – Hong Kong first class segment on Cathay Pacific:

- American Airlines – 67,500 miles

- British Airways – 105,000 Avios

That is a whopping difference (this is one-way)! It gets even more astounding when you add on the additional segments I had to Singapore and Sri Lanka in business class (AA stayed at the same amount of 67,500 miles). Since you can book the same tickets with American Airlines miles, it is almost always better to book such flights with AA miles than Avios.

BUT WAIT!

The only way you can accrue AA miles (other than directly through AA) is by transferring SPG points. In contrast, you can transfer Ultimate Reward points, SPG points, and Membership Reward points (often at a bonus) to British Airways. This means that it is infinitely easier to increase your Avios total over your AA total. As a result, the pain of the additional points required on British Airways over AA may be somewhat lessened.

However, again, the real savings comes with short-haul flights. At the lowest level, it takes 4,500 Avios for flights under 650 miles and one segment. The good part is that this works on partner flights, such as American Airlines. So, where AA may charge you 25,000 miles for the same flight, you can use 9,000 Avios! That is a significant savings. Here is a list of airports that are within that distance radius from Chicago for the Chicago Marathon.

Should You Apply?

While this is an exceptional offer, it is a valid question over whether or not you should apply. If you want to go for the big bundle of Avios, this is a great way to do it. However, it is worth considering the high amount of spend that you need to put on this card to receive the full bonus. Let’s consider this: to get the extra 50,000 Avios, you will need to spend $18,000 over the base required spending. If you were to spend that money on a different card, you can earn bonuses that give you even more points to transfer to Avios than the high-spend bonus would give.

If you can reasonably handle that amount of spending, I would suggest you apply for this card. Even if you can’t handle that much spending, you can still apply for this card as it only requires $2,000 in spending for the first 50,000 Avios. Finally, this card is from Chase – that means that you have to consider if this card is one that you are willing to use to bump off another card (if you have too many). It is all up to you!

Previous card holders are excluded from the bonus miles

Thanks, I will update it with that. That is the case with most Chase cards (except Marriott?)

The card gets 1.25 m/dollar so the 20,000 earned from spending really is 25,000 for a total of 125k

You are right – brain cramp here! Thanks for point it out!

Anyway we could get this card if we live in Australia?

As long as you have a US social security number, you can apply for this and other offers.

You also need a US address.. your cousin, friend or the Hilton Hotel in NYC