Right now, the Chase Sapphire Preferred and the Chase Sapphire Reserve are offering higher than normal bonuses. To help you maximize the points you can earn with these cards, here is a post to show how using points on groceries may be better than using them directly for travel.

Using Chase Pay Yourself Back to Pay for Travel

Link: Chase Sapphire Preferred New Offers | Chase Sapphire Reserve New Offers

The Chase “Pay Yourself Back” Program

Chase Ultimate Reward points have long been a very powerful and flexible tool for redeeming for great travel. They can unlock some awesome award redemptions with first class and business class in the air or hotel suites on the ground – when you transfer them to travel partners.

But, Chase Ultimate Reward points can also be used to pay directly for travel at a fixed rate. The Chase Sapphire Preferred offers a rate of 1.25 cents per point while the Chase Sapphire Reserve offers 1.5 cents per point. This has been a favorite for many because booking some travel this way can be cheaper than redeeming miles and the miles flown can count for earning miles or status.

However, last year, as part of Chase’s measures to deal with the coronavirus halt on travel, they introduced a feature called “Pay Yourself Back” which lets you use your Chase Ultimate Reward points at the same rate that can be used for travel to issue statement credits on grocery store purchases, dining purchases, and home improvement store purchases. This was great during a time when many cardholders were not traveling.

Now, Chase has extended this popular feature through September 30, 2021 while keeping the door open to the possibility that they may change up the redemption categories at some point.

How Is This a Great Way to Pay for Travel?

There are two components to why this is a great way to pay for travel. Let’s look at them here.

Earn Points on Travel Purchases

To start, let’s say that you have 10,000 Ultimate Reward points in your Chase Sapphire Reserve account. Those are worth $150 if redeemed for travel directly through Chase or as $150 if you redeem for statement credits on dining/groceries/home improvement purchases you have already made that have posted.

If you use those points to redeem for travel directly, you will not earn any points on the purchase of that travel. Instead, you are losing out on 2x, 3x, or even 5x (depending on the card used) point earning for travel bookings.

So, if you want to redeem your points for a flight that costs $150, you could redeem the Ultimate Reward points directly for that flight or you can Pay Yourself Back on grocery/dining/home improvement purchases and then use a card that earns big points on flights to pay for that flight. In this situation, you would earn 450 Chase Ultimate Reward points (if you used your Chase Sapphire Reserve) when you buy those tickets – worth another $6.75 for future redemptions.

Those are points you would not earn otherwise if you redeem your points directly for that flight. That makes this a great way to earn more points on spending!

Buy Your Travel on the Best Site

Next point is about where you buy your travel. If you redeem your points directly through Chase for a Hyatt hotel, for example, you will not be able to take advantage of any of your elite benefits (should you have any) and you will not get access to things like free internet, etc that the hotel makes available to any member (even non-elite) that purchase the room reservation through Hyatt directly.

But, if you redeem your points for groceries/dining/home improvement, you can then go directly to Hyatt to buy travel (again, earning bonus points on that purchase) and earn elite credit as well as bonus points and the perks that your Hyatt membership would give you.

This also is very good for flights. In the times we are currently in, I strongly advise people buy their airfare directly from the airline (especially in light of my experience with Chase as detailed in this post). Not only do you cut out the middle man if things go wrong but you also may be able to get a better price or a better combination of classes of travel.

How to Use Chase “Pay Yourself Back”

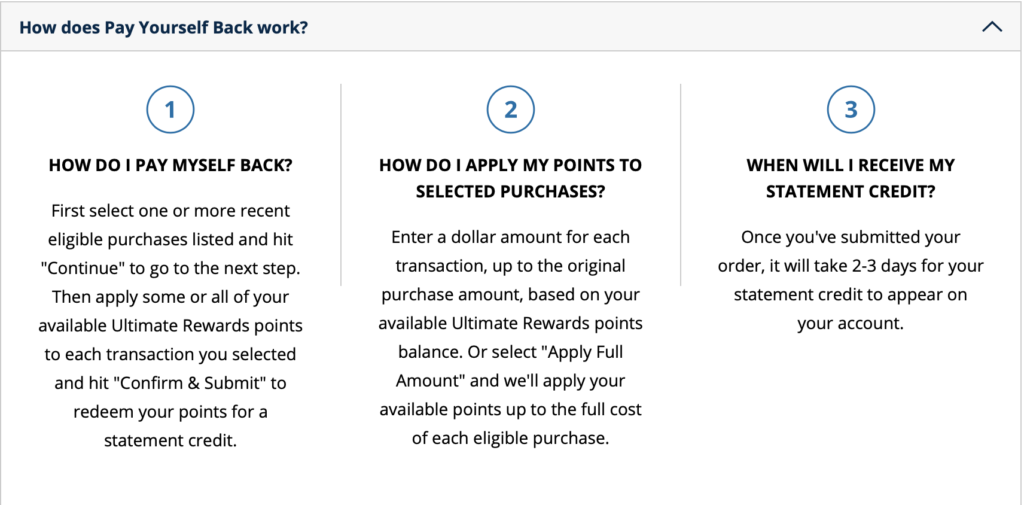

They have made this very easy to use! First, login to your Chase account, either on a computer or on your smartphone app. There you will see the option to Pay Yourself Back. This will show you the list of eligible purchases. Just go through and select each one you want to receive a statement credit for.

They have made this even easier by showing you the exact cost and the exact amount of points required to get the credit. Then you select if you want to refund it in full or partial for each amount. Then go ahead and submit it! In most cases, I get the statement credit the next day, if not, the day after that.

Bottom Line

Chase has created a fantastic way to use their Ultimate Reward points for more redemptions – redemptions which can pay you back so you can buy travel and earn more points! Of course, if you use your Ultimate Reward points strictly for luxury travel via travel partners, you may still want to do that (though, keep your eye out for some great business class airfare deals in the coming months as well – it could be better to use the method above in those situations!).

To get the best value in paying for travel with your Chase Ultimate Reward points, use those points to get statement credits on your grocery/dining/home improvement purchases and then use the best card to book your travel on the best site to earn more points!

Chase Sapphire Preferred – 80,000 Point Bonus Offer, worth $1,000!

The popular Chase Sapphire Preferred card is having a special bonus offer – 80,000 points and a $50 statement credit for groceries! This makes this offer worth at least $1,000 in travel, groceries, dining, or home improvement!

- Earn 80,000 points after spending $4,000 in three months

- Get a free $50 statement credit for grocery purchases!

- Transfer the points to popular airlines and hotels for maximum value!

- Use the points with Pay Yourself Back feature to pay for groceries, home improvement, and dining purchases

- Earn 2x points on all travel and dining!

- Annual fee of $95

- Application Link (this is an affiliate link that supports the site)