It seems like it has been a while since I opened a new credit card. In reality it has been roughly 2 to 3 months. Which if you knew me, is a lifetime :-). I have been on a cash back earning kick and that will remain my focus after I hit my spend requirements. What cards did I open on my recent credit card binge?

My Recent Credit Card Binge

I typically do not open cards without a goal in mind. Applying for cards without goals is never a great idea, as points devalue or you might have points in programs you have no idea what to do with.

My goal for opening these cards…

We have a friend in Taiwan we are considering visiting early next year. Even though I am a frugal traveler, I have very little interest sitting in coach for a 14+ hour flight. Although I could do it, I’d prefer not.

That said, there are some pretty solid bonus offers available, so I decided to take advantage of these offers. The plan is to book business class tickets, when the time comes, of course. Lots of pieces to put together before actually booking the tickets!

Card 1: American Express Premier Gold Reward

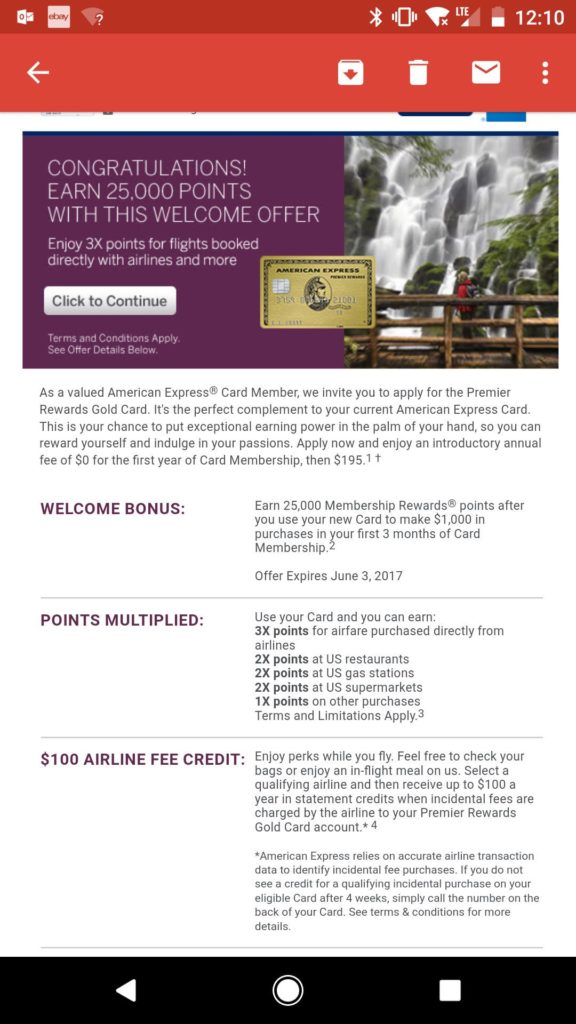

Both Kristin and I have had this card previously and I had no intentions of opening this card again. That was until Kristin received this:

While this is not the current 50,000 point offer that’s currently available, I’ll gladly take another 25,000 from this card. In addition to $200 in airline credits.

The spending requirement is a very easy $1,000 in 90 days.

This card made sense, because it is a bank point credit card and it provides flexibility. Most of our points are tied to Membership Rewards, since Delta is our primary airline from Bangor. This will also open up the possibility of using other airlines for a one way business class ticket.

Being targeted for this allows us to bypass American Express “once per lifetime” restrictions.

Card 2: SPG

I have always thought the SPG program is overvalued. That said, I think you have to be committed to earning SPG points or not. I am not committed to this program at all, but that doesn’t mean I can’t make the bonus from the card fit into my plans.

Right now, the “best public offer” is 25,000 points. If you told that is the best out there, they are being given wrong information. The best offer right now is a 30,000 point for $3,000 spendl. I missed the 35,000 offer a couple of months ago, but I’m happy with 30,000 points.

To find it you need to go incognito with your web browser. Interestingly enough, I could only pull this offer up through my phone, but not on my computer.

Why did I open this card?

Well, Kristin actually opened this card, but she found out after the fact :-P.

Since American Express combines hard pulls, it made perfect sense to apply for another American Express card. This card also allows flexibility and I can use for airlines or hotels. Most likely, I’ll use for airlines, because we have been using Airbnb more frequently on longer trips.

I have been running out of American Express cards I can earn a bonus on, so I think it was time I finally broke down and opened a SPG card.

This bonus will more than likely be used to transfer to American Airlines. After the bonus points post to the account, I will probably wait until there is a transfer 25% bonus to American Airlines. The hope is to earn 30,000 American Airline miles for 20,000 SPG points.

This will leave me around 10,000 for either a hotel stay, or I’ll move them to an airline (probably Delta).

If I chose to spend an extra $7,000 on the card, I’d have 40,000 SPG points which would mean 60,000 AA miles when that bonus comes around. Not sure if I’ll go that route, but it is still an option.

Cards 3 and 4: Barclay Aviator Red

Well for me, this was a no brainer. Back toward the end of last year Barclay made the Aviator Red card open to the public. At the time, I had said it was best to wait to apply. My prediction of a 50,000 mile offer was about 4 months off, but as predicted the bonus increased.

Although I have to pay 2 annual fees up front, earning 100,000 miles are well worth fees. I plan to buy some gum and put the cards in the sock drawer, until I receive some targeted offer, or cancel it. Thanks for the easy points Barclay!

We had these cards over 2 years ago (well ours were converted over), so we were both fine on receiving the bonus again.

I applied for both myself and Kristin, which Kristin was instantly approved for this card. My application went to pending, and since Barclay can be tough, I was a little worried.

I did call in to answer questions, because I am too impatient and needed a decision :-). After answering some questions about income and why I had 4 inquiries in the last 6 months (I thought to myself, that’s all?). I was approved and the card was being sent out.

I think cards like these, that offer a great sign up bonus for 1 purchase is amazing. This doesn’t interfere with reaching spending requirements for other cards, I wish more cards were like this 🙂

Total Rewards Earned: 155,000 points, $200 in airline credits, plus paying $190 in annual fees.

Conclusion:

With this round of cards, I’ll be able to book 2 one way business class tickets to Taipei (TPE). I’m considering either Japan Airlines, or Cathay Pacific for this flight. On the way home, I’ll probably utilize some Skymiles for 2 business class tickets home. If you have recommendations on what airlines to use these miles on, I’m happy to listen!

This was a pretty good haul for a grand total of $4,000 spend and 2 annual fees up front. The value of the tickets I plan to book, far exceed the cost to earn these points. Now I plan to cool it for the next 4-6 months on cards and earn more cash back.

What cards have you opened recently? Have you taken advantage of any increased offers?

Don’t forget to Like me on Facebook, or Follow me on Twitter. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!

Lot of trouble to go through if all you want is AA miles. Why open an SPG card now on the if-come of an offer that doesn’t yet exist to turn it into 50K AA miles someday? Why not open a 60K AA miles Citi card today? Then add a business AA miles Citi card next week?

Hey Mike,

Those are great points, but there is no guarantee we see a higher SPG offer. I took AA miles, because I almost have enough now for 2 one way biz class tickets. 50k AA for one purchase was more desirable than 60k for $3k spend (since I don’t MS).

Thanks for reading! I appreciate it!

Dustin

“Being targeted for this allows us to bypass American Express “once per lifetime” restrictions” – WHAT? I didn’t know about that.

A few questions:

– Does this apply to all AMEX cards?

– How can you find out if you’ve used up your “once per lifetime” opportunity at a card?

– By “targeted” – what form does it come in? Postal mail? Email? Website pop-up?

Learned something new today. Thanks!

Hey Tom,

This was the first time we had this targeted offer come our way, so I was pretty excited to see it happen!

To see if you have had the bonus before on a card, you can ask one of the reps. That can be done via chat. Odds are if you had the card, you’re not eligible again.

I believe being targeted will bypass the “Once per Lifetime” opportunity for all Amex cards.

We received ours via postal mail. It even came with no language mentioning excluding us since we have had the card before. There was a code for my wife to use to bring up her offer. The offers online will show you a point offer, but in looking they do have exclusion language. I have asked about that before :-).

Thanks for reading! I appreciate it!

Dustin