The popular Chase “Pay Yourself Back” program has been extended past their original ending date of September 30. This is great news by itself but Chase is also adding more cards to the program. Here are the details about this program.

Chase “Pay Yourself Back” Program Extended and Expanded

This has included allowing the Chase Sapphire Preferred and Chase Sapphire Reserve to use their awesome travel redemption rates to pay yourself back on things like groceries and home improvement.

How the Chase “Pay Yourself Back” Program Works

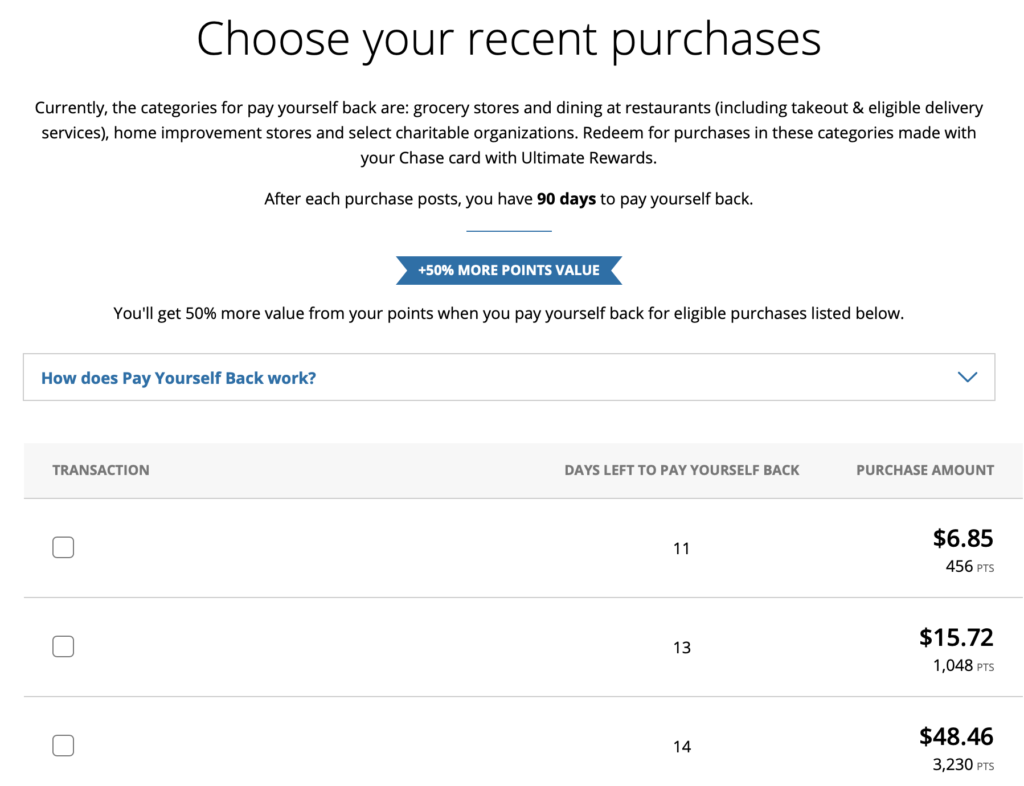

How this works is that you login to your Ultimate Rewards account and choose to Pay Yourself Back. You will see a list of eligible purchases (supermarkets, restaurants, food delivery, home improvement stores) and you select which purchases you want to redeem points for.

It shows you the amount and the amount of points it will take to issue the rebate to your account. You have 90 days from the time of purchase to pay yourself back. Once you do, you will receive a statement credit for that amount in just a couple of days!

Plus, you will still earn points on the spending you did for that as well! So, this is a nice way to get a good rebate while also earning points, especially bonus points, on the spending.

If you have the Chase Sapphire Preferred, you will be using 1 point for every 1.25 cents you want to redeem. The Chase Sapphire Reserve will give you 1.5 cents for every point – just like with direct travel redemptions.

How the Chase Pay Yourself Back Program Has Improved

Now, this program for the Chase Sapphire Preferred and Chase Sapphire Reserve will run until April 30, 2021. This is great news indeed as it will allow people to redeem their Ultimate Reward points at maximum straight redemption value for everyday purchases like groceries.

They are also adding several charities that this will work with as well. Those are:

- American Red Cross

- Equal Justice Initiative

- Feeding America

- Habitat for Humanity

- International Medical Corporation

- Leadership Education Fund

- NAACP Legal Defense and Education Fund

- National Urban League

- Thurgood Marshall College Fund

- United Negro College Fund

- United Way

- World Central Kitchen

Chase Freedom cards will also have this feature for charities as well.

Expanding to Chase Business Cards

This program is also expanding to Chase Business Ink Preferred cards and the old Chase Ink Business Plus cards. These redemptions will be for business-type expenses for reimbursement. Those are select online advertising and shipping.

But, if you have a Chase Sapphire Reserve or Chase Sapphire Preferred, you can always transfer your points from any Chase Ink card or Chase Freedom card to the Reserve or Preferred. This will let you redeem your points for groceries or home improvement expenses if you want to really maximize your point redemptions.

This Program is a Great Way to Pay for Travel

Make sure you read this post for a greater breakdown, but I have been using this Pay Yourself Back promo to actually pay for travel – with greater rewards than using the points for travel!

Now, here is how I am paying myself back on groceries to pay for future travel. I am no longer using Chase Ultimate Reward points to pay for travel through Chase – it just does not make sense for a couple of reasons.

One is that I do not want to deal with a middle man on airline tickets anymore, I want to book directly with the airline. The other is that I can earn 3X points on the outright travel purchase while paying myself back on past grocery store purchases!

So, we have some upcoming travel later this year. I purchased the tickets with my Chase Sapphire Reserve card – earning 3X points per dollar. After, I went back into my Pay Yourself Back part of my Chase app and began to select the grocery store/dining purchases I made in the past 90 days until I selected enough to pay for the travel I just booked.

Bottom Line

Chase has been crushing it in this Covid time in trying to extend value on their travel-heavy cards to expenses that we are all using right now. This latest extension and expansion is great news for anyone that has enjoyed using these points in this way.

Hi Charlie!

Great expansion of the Pay Yourself Back program. Chase really has been stepping up. Thanks for this post. I’d add another trick to squeeze out maximum value. My husband has chase sapphire Preferred and I have chase sapphire Reserve. You mentioned that the redemption rates are 1.25 for Preferred and 1.5 for Reserve, so obviously it’s best to redeem with Reserve. Since my husband is in my household, we transfer his Preferred points to my Reserve, then redeem for the greater redemption rate. Cheers!