I know everyone has probably seen Hyatt’s newest promotion, but this is not related to that. Although you could couple this to that promotion, but that’s not the point of this post. Today I received an email from Hyatt letting me know about a promotion to earn bonus Hyatt points with my credit card. What is it the promotion and is it worth it?

Earn Bonus Hyatt Points (Targeted)

The Deal:

You will need to register for this promotion and in the email there was a button that lead you to the screen (although when I clicked it, Chase says they are down for maintenance!)

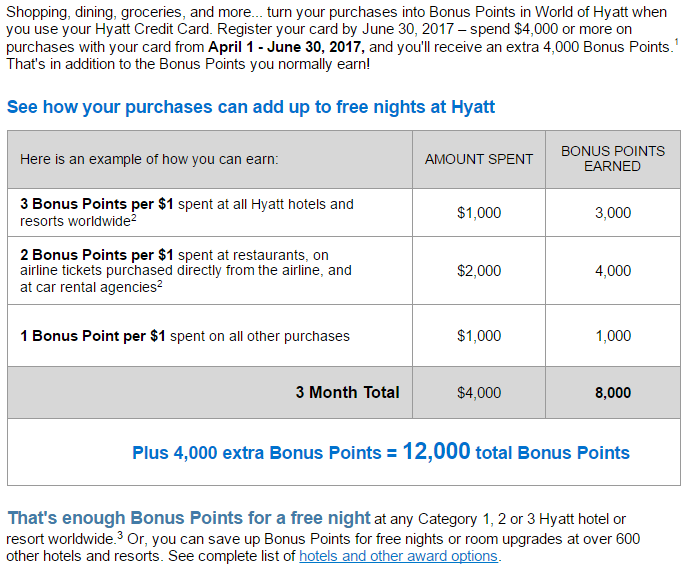

If you spend $4,000 or more between April 1st and June 30th (Quarter 2 for 5% rotating cards), you will receive 4,000 bonus points! This essentially makes the card earn a 2x Hyatt points on all non-bonus spend.

The criteria to be eligible and earn the bonus points:

- Log on to the website referenced in this offer and enroll by 06/30/17

The promotional offer is non-transferable and applies only to the account ending in the last 4 digits referenced in this offer.

Is the deal worth it?

This is very much dependent on your goals! I think if you have other Chase cards that earn Ultimate Reward points, I would pass on this deal and use those.

The 4,000 extra Hyatt points is almost enough for a category 1 property in itself. The minimum total amount of points earned would be 8,000 which is enough for a category 2. This doesn’t include any points and cash options either.

If you had the Hyatt card and that is your daily card or even a cash back card that earns 2%, I would consider using the Hyatt card. Depending on how you value your Hyatt points (many value at 2 cents per point; I don’t), you would be looking at a 4% return on non-bonus spending. Which is pretty fantastic if you value Hyatt points that high.

The amount you’d need to spend in the next 3 months is quite high as well. I would much rather put $4,000 towards a new spending requirement myself.

Overall:

If you have no other spending requirement(and targeted) and not opening a new card, you might want to consider this bonus offer. The spending requirement is quite high for 4,000 bonus points.

That said, I think this is a pretty solid bonus offer if you can meet the requirements of $4,000 or more from April 1st to June 30th.

This is by far a much better offer than IHG offer that was sent out the other day to people. And if I had a choice between them, the Hyatt card would be the clear winner.

Were you targeted for this offer from Hyatt? If you were, are you going to earn those bonus points?

Don’t forget to Like me on Facebook, or Follow me on Twitter. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!

Nope! WOH = World of Hurt

Hey John,

Hyatt’s new program definitely seems to be hit or miss for people!

Thanks for reading,

Dustin

Good comparative analysis on how this bonus often won’t be a win.

I wonder if anyone in the initial Hyatt card sign up spend period is eligible for this bonus (unlikely), and whether it then stacks with the sign up bonus?

Hey Daniel,

Thanks! My gut would tell me no on new cardholders being eligible for this. I think many people use these for the annual benefit and not for everyday spend. If they were though, I would totally think it would stack, which would be awesome!

These cards need to somehow wow people to use them for everyday spending. For the most part hotel cards are “Blah” for everyday spend.

Thanks for reading!

Dustin