Marriott recently announced their upcoming changes to their award program. Once these changes take effect, some in August, others in 2019 you might be deciding between Marriott and Hilton. Let’s take a look to see which program would be better.

Deciding Between Marriott and Hilton

I think the big bloggers out there are giving Marriott a break. This was a devaluation of the program and their credit cards.

Credit Cards:

Of course I will start here, because well I really like credit cards.

| Credit Card | Bonus | Earning Rate | Annual Fee | Status | Benefits |

|---|---|---|---|---|---|

| American Express Hilton Aspire | 100k Hilton Honor Points after $4k spend | -14x at Hilton Hotels - 7x booking flights through airlines or Amex travel, restaurants, and direct car rentals -3x Everywhere else | $450 | Diamond Status | -Weekend night every year - Another weekend night after $60k spend -$250 Hilton Resort Credit -$250 Airline Credit -Priority Pass access - $100 hotel credit when booking 2 nights or more |

| American Express Hilton Ascend | 100k Hilton Honor Points after $3k spend | -12x at Hilton Hotels -6x at US grocery stores, gas stations, and supermarkets -3x Everywhere else | $95 | Gold Status | - Free weekend night after spending $15k - 10 Priority Pass Lounge passes per year - Earn Diamond status after spending $40k in a year |

| American Express Hilton Honors | 50k Hilton Honor Points after $1k spend | - 7x at Hilton Hotels - 5x at US grocery stores, gas stations, and supermarkets - 3x Everywhere else | $0 | Silver Status | -Earn Gold status after spending $20k in a year |

| American Express Hilton Business | 100k Hilton Honor Points after $4k spend | - 12x at Hilton Hotels - 6X Points U.S. gas stations, wireless telephone services purchases directly from U.S. service providers, U.S. purchases for shipping -6x at U.S. restaurants, flights booked directly with airlines or with AmexTravel.com, car rentals booked directly from select car rental companies 3x Everywhere Else | $95 | Gold Status | - Free weekend night after spending $15k - Another weekend night after spending $60k - 10 Priority Pass Lounge passes yearly - Earn Diamond Status after spending $40k |

| American Express SPG | $100 after spending $1,000 (although Amex says it will increase again), and $100 statement credit after first purchase at SPG/Marriott hotel | - 6x at SPG and Marriott Hotels - 2x Everywhere else | $0 for year 1, then $95 | Silver Status | - Free night certificate (up to 35k points) -Gold status after spending $30k in a year - 15 night credit towards status |

| American Express SPG Luxury | TBA | - 6x at SPG and Marriott hotels - 3x points at U.S. restaurants andflights booked directly with airlines - 2x Everywhere else | $450 | Gold Status | -Can earn Platinum Status after spending $75k -Free night certificate (up to 50k points) - $300 Marriott Credit - TSA Precheck/Global Entry Credit - Boingo WiFi - Priority Pass access - 15 night credit toward status |

| Chase Marriott Premier | 80k after spending $3k | -5x at SPG and Marriott Hotels - 2x Everywhere Else | $85 | Silver Status | - Free night certificate (up to 25k) - 15 night credit toward status - 1 elite night credit for every $3k spent |

| Chase Ritz- Carlton | 2 free nights at category 1-4 after spending $4k | -5x at Ritz Carlton & SPG hotels -2x on airline tickets purchased directly from airline, car rental agencies, and restaurants -1x Everywhere else | $450 | Gold Status | -$100 Hotel Credit -Platinum Status after spending $75k in a year -$300 travel credit -Airline ticket discount - TSA-Precheck/Globel Entry credit - Priority Pass Access - Car rental benefits - Auto rental primary coverage |

| Chase Marriott Premier Plus | 100k after $5k spend | - 6x at Marriott and SPG hotels - 2x Everywhere else | $95 | Silver Status | - Free night certificate (up to 35k) - Gold status after spending $35k - 15 night credit towards status - Free wifi |

| Chase Marriott Premier Business | 75k after spending $3k | - 5x at Marriott and SPG hotels - 2x at office supply stores, restaurants, car rental agencies, tickets bought directly through airlines, internet/cell phone/cable - 1x Everywhere else | $99 | Silver Status | - Free night certificate (up to 25k) - 15 night credit toward status - 1 elite night credit for every $3k spent - Gold status after spending $50k |

| Chase Marriott Consumer Credit Card | No bonus | -3x at Marriott and SPG hotels -1x Everywhere else | $45 | Silver Status | - 10 night credit towards status - 1 elite night credit every $3k spent - Free night certificate at category 1-4, after spending $25k |

| Chase Marriott Business Credit Card | No bonus | -3x at Marriott and SPG hotels -1x Everywhere else | $45 | Silver Status | - 10 night credit towards status - 1 elite night credit every $3k spent |

| American Express SPG Business | $100 after spending $1,000 (although Amex says it will increase again), and $100 statement credit after first purchase at SPG/Marriott hotel | - 6x at SPG and Marriott Hotels -4x atU.S. restaurants, U.S. gas stations, wireless telephone services purchased directly from U.S. service providers, and U.S. shipping purchases - 2x Everywhere else | $0 for year 1, then $95 | Silver Status | - Free night certificate (up to 35k points) -Gold status after spending $30k in a year - 15 night credit towards status |

You’ll notice there are more co-branded credit cards that earn Marriott points, but the bonuses on the Hilton cards offer more points.

The status level you’ll receive are better with the Hilton credit cards as you can “earn” Diamond status with the Hilton Aspire credit card.

The earning rates directly on the property favors Hilton over Marriott as well.

It is an absolute joke that the SPG Luxury card gives you (meaningless) Gold Status, but you can earn Platinum Elite after spending $75,000 on the credit card.

Since the personal Marriott card fall under the 5/24 rule, I’d be willing to bet the new Marriott Premier Plus will be in there as well, when it is released May 3rd.

At the same time, I think the “Once in a Lifetime” rule will be enforced not the “refreshed” SPG card. That means many of you really have access to the new SPG Luxury card and the Marriott Business cards, since they don’t fall under the 5/24 rule.

Earning Rates on the Credit Cards:

Let’s just clarify this now, the SPG card was devalued. While I was never a fan of the card, I realize many people used it as a non-bonus card or even as their main card. I think with the new earning structure there isn’t a reason to actually use this card.

The new Marriott Premier Plus and SPG Luxury lead the way with 6x Marriott Points when booking hotel stays. Beyond that all the cards earn a very unappealing 1-2x depending on the card and category in which you spend.

The Hilton Ascend and Hilton Aspire earn 12x and 14x when you pay for your Hilton stays. This is at least double the earning rate for the Marriott cards! The other categories range from 5x to 7x depending on your card. For all non-bonus spend you earn 3x Hilton Points.

For the earning rates, you have to give this one to Hilton, they out earn the Marriott card in every aspect.

Annual Fees:

The Marriott credit card (including the SPG cards) annual fees range from $45 to $450 depending on the credit card you select.

The Hilton credit card annual fees range from no fee to $450 depending on the credit card you select.

I will give the nod to Hilton for this round. You can downgrade to a no fee credit card with Hilton, but unfortunately with Marriott it looks like you are stuck with a $45 fee for even their lowest tier card

Benefits:

We are going to look at the mid level and high level cards here.

The Hilton Ascend gives you 10 Priority Pass Lounge Passes and complimentary Gold Status, with the ability to earn Diamond Status after spending $40,000 (don’t do that though). All for $95 per year

The Hilton Aspire gives your Diamond Status, Unlimited Priority Pass Lounge access for you and 2 other people, $250 Hilton Resort Credit, Free night each year and another after spending $60,000 each year, and $250 airline credit. All for $450 per year

The Marriott Premier Plus a free night certificate (up to 35,000 points) after each renewal, Silver Status, with the ability to earn Gold Status after spending $35,000 in a year, and 15 night credit toward status (hence you get Silver Status). All for $95 per year

The SPG Luxury you receive Gold Status, with the ability to earn Platinum Elite after spending $75,000 in a year (give me a break), $300 credit statement for purchases at Marriott hotels, $100 TSA-Precheck/Global Entry credit, free night up to 50,000 points after each renewal, and Boingo Wifi.

The winner for this one will come down to your preference. If you like status, then Hilton is clearly the choice with Gold and Diamond for their respective cards. The SPG Luxury has an absolutely foolish (did Barclay help with this?) spending requirement to reach Platinum Elite.

If you prefer the free nights, then Marriott is your clear winner. You will get a certificate for their cards, unlike Hilton where you only get it for the higher end card.

Status:

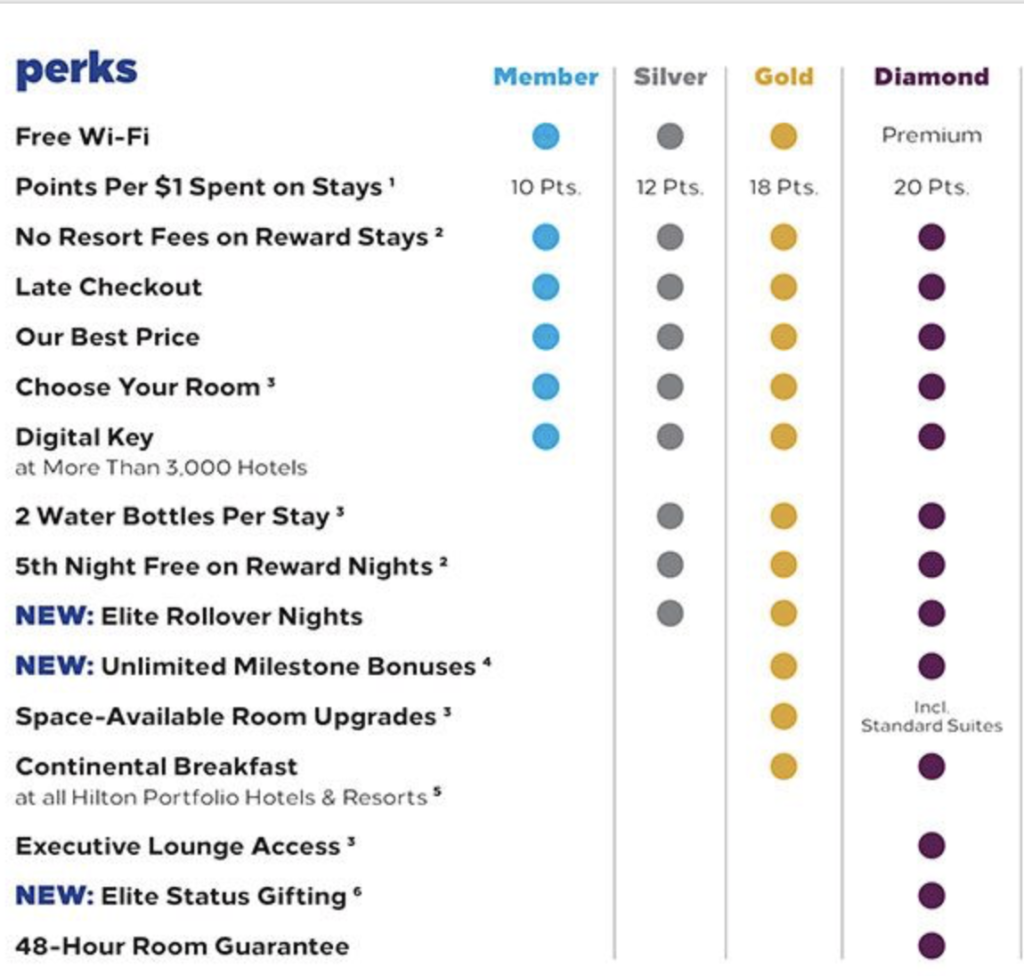

Starting off with Hilton:

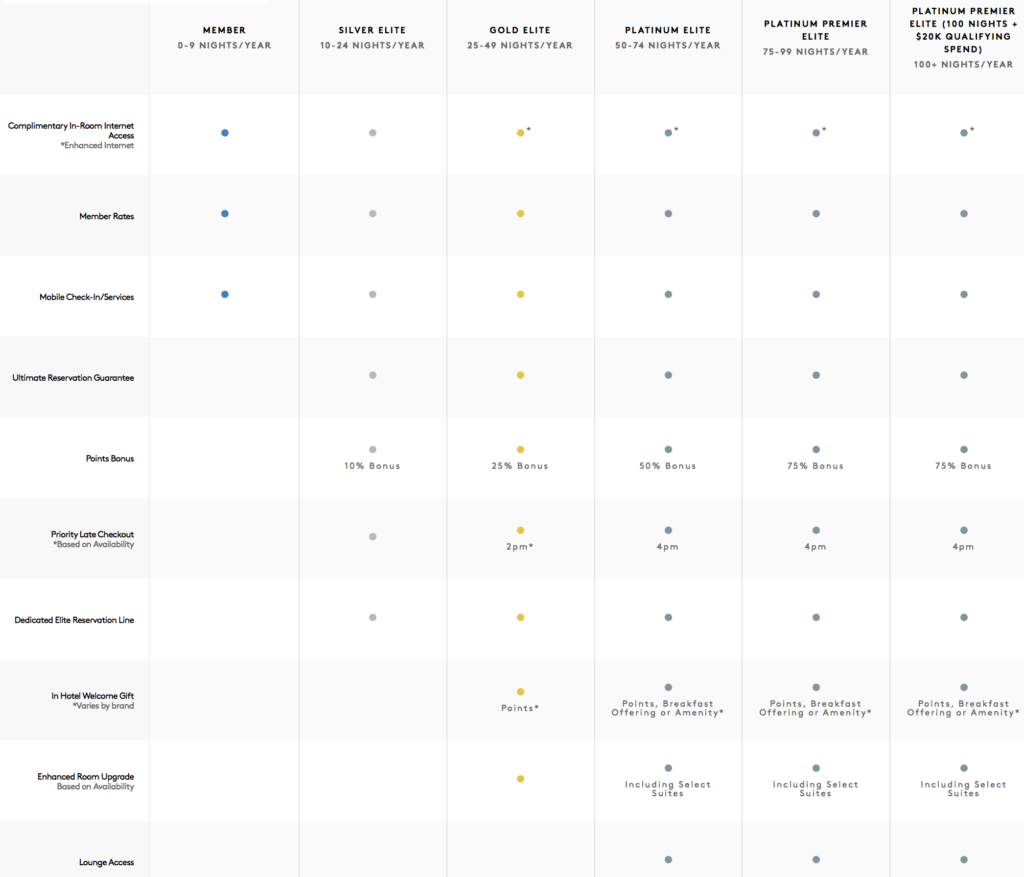

Now to Marriott’s upcoming chart:

When taking a look at these 2 programs, the differences really start around the Gold status. If you’re under the Gold status line, you don’t receive much for benefits from either program.

Once you hit Gold status with Hilton (which you can earn via Hilton credit card), you get free breakfast at Hilton hotels, no resort fees on award stays, and 18 points/dollar spent (not including your credit card bonus).

The Hilton Diamond status (which you can earn via Hilton credit card), you get the benefits of the Gold members, plus lounge access, “premium” WiFi, and 20 points per dollar (not including your credit card bonus).

Marriott made some unfavorable changes to their status benefits.

The base points awarded is 10 points/dollar for all members, then come their bonuses based on status.

The Silver status (which is pretty much all the Marriott cards) earn a 10% bonus on paid stays (this is reduced from 20%).

The Gold members really got hit the hardest in my opinion. They lost their free breakfast, lounge access, and had their late checkout reduced to 2pm, vs 4pm. Gold members do get to keep the 25% bonus on points/dollar spent (not including your credit card bonus).

While Hilton gives Diamond status to their top credit card customers, Marriott wants you to spend $75k to earn this. Marriott Platinum members will earn a 50-75% bonus on points earned for paid stays (this does not include credit card bonus). Platinum members will have the option to pick breakfast as an welcome gift, and they will receive lounge access.

I think Hilton members have it better when it comes to the status levels. Gold will give you much more value from Hilton than it does with Marriott. Breakfast is a big reason for this. Plus if you have an award stay, Hilton does not charge resort fees, but Marriott will.

The only way I see Marriott coming out ahead is if you’re a Platinum Premier Elite and you want to turn those Marriott points into airline points.

Example:

We’ll take a look at how much each status level would earn in points if they were to spend $800 total for a room.

| Program | Status | Earning Rate | Points Earned on $800 | Co-branded credit card earnings | Total for Co-branded and Status |

|---|---|---|---|---|---|

| Hilton | Member | 10 | 8,000 points | Co-branded give status, excluded | Co-branded give status, excluded |

| Hilton | Silver | 12 points/ dollar | 9,600 points | 5,600 points | 15,200 points |

| Hilton | Gold | 18 points/ dollar | 14,400 points | 9,600 points | 24,000 points |

| Hilton | Diamond | 20 points/ dollar | 16,000 points | 11,200 points | 27,200 points |

| Marriott | Member | 10 | 8,000 points | Co-branded give status, excluded | Co-branded give status, excluded |

| Marriott | Silver | 11 points/ dollar | 8,800 points | 4,800 points | 13,600 points |

| Marriott | Gold | 12.5 points/dollar | 10,000 points | 4,800 points | 14,800 points |

| Marriott | Platinum Elite | 15 points/dollar | 12,000 points | 4,800 points | 16,800 points |

| Marriott | Platinum Premier Elite | 17.5 points/dollar | 14,000 points | 4,800 points | 18,800 points |

“Award Charts”

We should really call this the lack of award chart. Hilton is already a dynamic currency and in 2019, Marriott will be joining them.

Also, you should keep in mind, both programs have a 5th night free when redeeming your points.

Hilton:

Well, I would have posted an award chart, but Hilton doesn’t have one. This can make it a bit frustrating when working with Hilton, but you can see the variations when you search their hotels.

Some nights are less and others are more, but I don’t feel Hilton really increases the rates although without a chart, they could Delta us and make adjustments without notice.

They do have a nice benefit of using points and cash, but you have to redeem a minimum of 5,000 points and you can use cash to pay the rest.

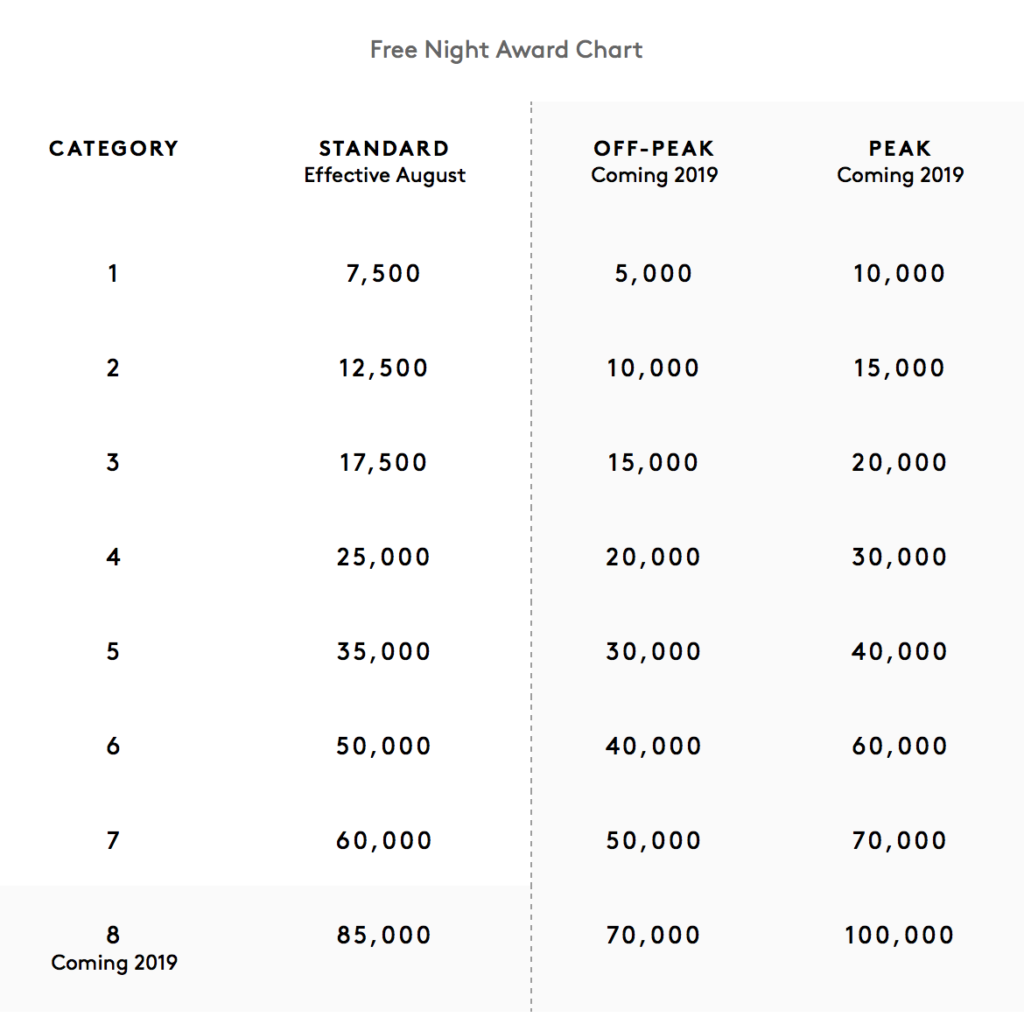

Marriott:

Call my skeptical, but I think we will see many of the SPG hotels be on the higher tier of this chart. Hopefully I am wrong.

I’ll also be curious what Marriott considers “Peak” season, because this will adjust the free nights you earn from your credit cards.

If you take a look at the credit card chart above, you’ll see your Marriott free nights are good for a certain point value. For example, if your certificate was good for a room up to 35,000 points you’d only be able to redeem for a category 4 during peak season, and category 5 during standard/off-peak.

I think it is only a matter of time before Marriott does away with their award chart and is completely dynamic in pricing.

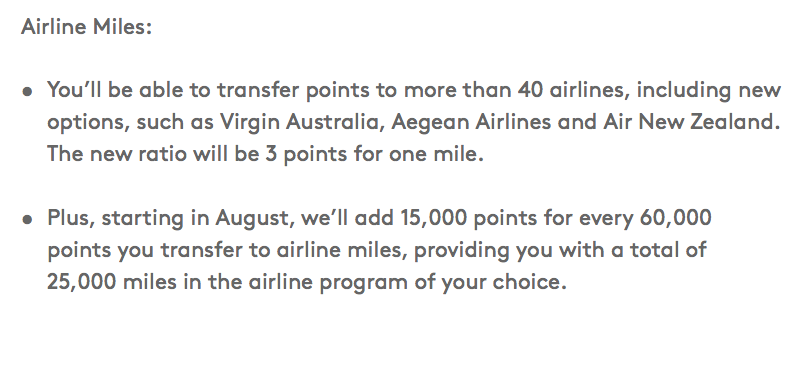

Airline Transfers:

Well, for Hilton this is not worth your time to move your Hilton points to an airline. I think that pretty much sums my explanation of Hilton points to airline transfer.

This section was really meant for Marriott anyways.

Marriott is keeping the SPG airline transfer partners and adding a few others as well. When you transfer 60,000 Marriott points, Marriott will give you an extra 15,000 points (total of 75,000 points), and you’ll receive 25,000 airline miles.

This is keeping that ratio you have know from SPG the same. But, with the reduced credit card earning rates, you are going to need to spend more money in order to hit the 60,000 point mark.

You could transfer your Ultimate Reward points over, but I really can’t see many people moving 60,000 points of valuable Ultimate Reward for 25,000 airline miles. You would need to get some pretty serious value from them.

If these airline partners are that important to you, then Marriott is clearly going to be a better currency for you to use.

Deciding between the programs?

This one is definitely going to depend on your goals and how much you travel.

For the road warrior who spends hundreds of nights on the road? I think you might be better off with Marriott. This is mainly due to the fact you’ll earn a lot of points which you can use for airline partners.

The more casual traveler, you can earn all the status you need with Hilton through one of their credit cards. There is no need to mattress run or go all crazy to earn their status. Hilton’s free breakfast at the Gold level is a great benefit for families or people who want to save money while they travel.

I’m wanting to see what happens in 2019 for Marriott with rooms and their availability. By Marriott moving down the dynamic redemption path, they are gearing up to completely follow Hilton with a pricing model. I don’t think everything is all sunshine and rainbows like they presented at their event.

I’ll personally favor Hilton over Marriott when it comes to my hotel stays. The breakfast and lounge access are solid and my Hilton Surpass gives me Priority Pass access, which I really like. Marriott’s Gold status really doesn’t compete in my eyes.

Conclusion:

I think Marriott really missed the mark with the credit card offerings, which might turn people over to Hilton. The only place where I see Marriott possibly keeping people is with their airline partners. But, many of you would still be better off earning Ultimate Rewards than Marriott points.

Which program do you think is better?

Consider Subscribing to my YouTube Channel, Like me on Facebook, or Follow me on Twitter. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!

Hi Dustin,

I’m currently debating between the 2 chains and your analysis is helpful. I could still use your opinion. You broke it down to work travelers/casual travelers, but what about infrequent travelers? I usually have no more than 3-4 stays a year, and only travel international once. For someone like me, it’s less about status/spend, and more about free nights I think. In my case, I think it comes down to:

Hilton: $250 airline credit, weekend cert, $250 resort credit (this is iffy, as I’m not sure I’d use it)

Marriott/SPG: free night at 50k, $300 credit towards a room

Depending on the award chart for Marriott, I’m thinking the SPG Luxury card is actually a better deal for me. Am I following the right train of thought?

small edit, I meant to say I travel international once a year

Hey Kitae,

It seems you have a good thought what works for you. The Aspire has a free weekend night, but that doesn’t help you if you stay during the week.

Are you likely to stay at a property that is a category 6 or lower? Or do you prefer top end categories? Also take into account we don’t know the bonus for the SPG Luxury yet. If it is only 50k (for example) the Hilton bonus would better for an award stay.

But with what you have down, I think the Marriott card might work better for your travel preferences.

Hope that helps.

Thanks for reading! I appreciate it!

Dustin

Thank you so much Dustin for such a great article. you laid down everything so well. I am SPG/Marriott Gold via Amex Platinum and after the new changed go in August further, I will most probably acquiring Amex ASPIRE by Hilton. Marriott has (After taking away the Lounge access from Spg Business card and Breakfast and lounge perk from Marriott Gold members) left us with no choice but to switch to Hilton and Hyatt. I will still keep my 450k MR points stash for future Hotel + Flights package and Airline transfers and (occasionally SPG/Marriot property) but cannot see myself spending more on SPG cards (they are gonna be in my sock Drawer) from August 1st as i will just keep them for my free night capped at 35k.

Even tho im only discoverist with Hyatt, i find Hyatt so much better for my preferences (Hyatt places starting with only 5000) and (upgrading my stay to a club lounge for only 3k Hyatt points is a clutch) and where i wont be able to find Hyatt hotels, Hilton would come to the rescue.

Hey Leo,

Thank you! I really like Hyatt for hotel stays, I just wish their footprint was larger! I agree, we have a similar idea of hotel preferences :-).

Hilton will get more of my hotel stays since I like my Gold status from my Ascend card.

Thanks for reading! I appreciate it!

Dustin