Choice with credit card offers is always a good thing! When you combine that choice with one of the most popular travel cards of all time, it gets even better. Today, the Chase Sapphire Preferred 60,000 point offer has moved out of the branches and on to the website. So, this gives you the choice of which offer you want to go for.

New Chase Sapphire Preferred 60,000 Point Offer

I know, 60,000 points beats 50,000 points, right? I would say a resounding “YES” but with the inclusion of the annual fee for the first year on the 60,000 point offer, some people may halt. Really, I think paying $95 for 10,000 Ultimate Reward points is a really nice deal since you can use those points from the CSP at a minimum of 1.25 cents each on travel. But, some people have other ways of generating Ultimate Reward points for less so they would prefer no annual fee. The choice is yours (but you really should pick the 60K point offer – and you will see why!)

Chase Sapphire Preferred 60,000 Point Offer

Link: Chase Sapphire Preferred 60,000 Point Offer

Here’s the thing – even if you don’t want to pay for the $95 annual fee up front, the 60,000 point offer still makes good sense. That is because you can take the extra 10,000 points as a statement credit of $100 and wipe out the annual fee yourself! Easy as that!

Here are the details of the new Chase Sapphire Preferred 60,000 point offer:

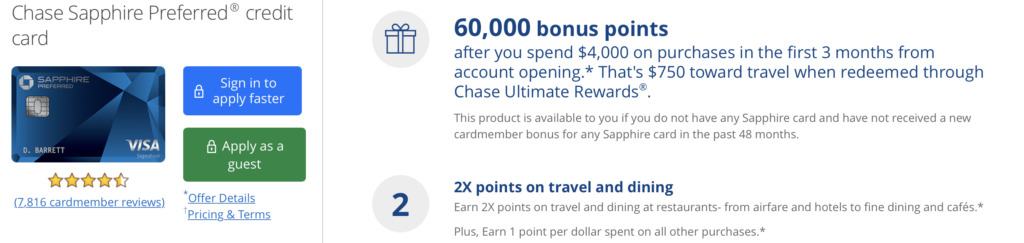

- 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

- 2X points on travel and dining – Earn 2X points on travel and dining at restaurants- from airfare and hotels to fine dining and cafés.

- Plus, Earn 1 point per dollar spent on all other purchases.

- 25% more in travel redemption – Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Ultimate Rewards. For example, 60,000 points are worth $750 toward travel.

- Annual Fee (not waived) $95

Chase Ultimate Reward points are some of the most valuable points around. Not only can you use them to pay for travel directly through the Chase portal at 1.25 cents per point (with the Chase Sapphire Preferred card) but you can also transfer them to several partners at a 1:1 ratio for some really great travel deals. Here are the travel partners you can transfer to:

Airline Travel Partners

- Aer Lingus, AerClub

- British Airways Executive Club

- Flying Blue AIR FRANCE KLM

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards®

- United MileagePlus®

- Virgin Atlantic Flying Club

Hotel Travel Partners

- IHG® Rewards Club

- Marriott Bonvoy™

- World of Hyatt®

My personal favorites are United (for a business class award between the US and Europe on United at just 60,000 points), Hyatt (our favorite Hyatt is 8,000 points per night), Southwest (at around 1.5 cents per point, it is a great constant partner to look to), British Airways (for those short-haul flights at just 4,500 points abroad or 7,500 points in the US).

Redeeming your Chase points for United business class is a nice way to use them!

Of course, my favorite use of them is to transfer them to my Chase Sapphire Reserve account where I get 1.5 cents per point when redeeming for travel through Chase! 🙂

Chase Sapphire Preferred 50,000 Point Offer with No Annual Fee (first year)

After all that above, if you still want the Chase 50,000 point offer, here is the link for you. 🙂 You won’t have an annual fee the first year and everything else is the same as the above offer. Please know that if you apply through this link and are approved, I will get 10,000 Ultimate Reward points as well.

But, Can You Get It?

Don’t forget the all-important Chase rules – This product is available to you if you do not have any Sapphire card and have not received a new cardmember bonus for any Sapphire card in the past 48 months.

And the dreaded Chase 5/24 rule where you are not able to get a Chase card if you have opened 5 new accounts (with any bank) in the last 24 months.

But, if you are clear of all that, the Chase Sapphire Preferred 60,000 point offer is a really good one to go for! Do remember that you will not be able to apply for the Chase Sapphire Reserve for 48 months after this bonus but you can upgrade to it (which is a good move if you travel a few times each year).