‘Tis the season for credit card spending bonus offers. I have seen several floating across my twitter feed today, all targeted, as we head into April. I have seen some for Chase over at Travel with Grant as well as receiving my own offer for 2x miles up to 2,500 bonus miles.

A 10% Cash Back Offer From Citi That Failed to Excite Me

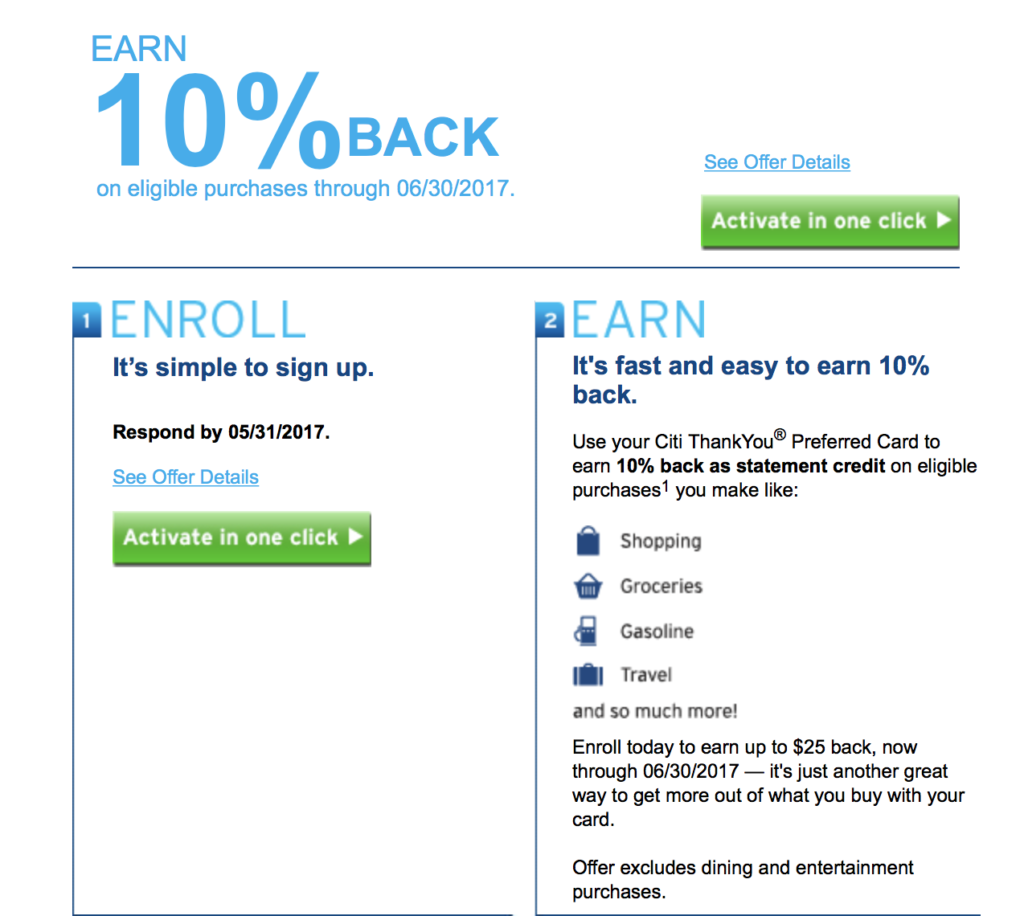

I received another targeted offer tonight with a header line that read “Earn 10% Back on Eligible Purchases Through 06/30/2017.” Of course I was a little excited about such an offer but I knew there had to be a low cap. I was planning to do a post on this targeted offer to tell others about it as well but then wondered if people would feel as let down as I did when I saw the cap. 🙂

10% Back … Up to $25 Credit

Sure enough, the cap is a max cash back amount of $25. That means I can use my Citi ThankYou® Preferred Card for $250 in spending to get $25 back. Yes, I know that $25 is $25 and I get excited about Amex Offers that return that amount. But, the difference is that most Amex Offers that are giving me back $25 are doing so at a much higher percentage than 10%.

Better Than Amex Offers?

However, this Citi offer is not limited to a specific retailer, like Amex Offers are. So, this is essentially a $25 back offer on $250 that I spend anywhere – except for dining and entertainment. I could purchase a $250 grocery gift card and then have 10% off all groceries up to $250. That would work and, again, it is giving me $25.

I just couldn’t get as excited as the e-mail wanted me to be after making broad claims of the 10% back and then hiding the $25 cap in the regular text with no highlighting. If I have a single purchase of $200-$250, I will probably use this card. But I am not sticking it in my wallet when I have other cards that I prefer to use for other categories and that I get more value from than $25 – even getting cash back on Chase Freedom categories is more exciting since I can transfer that to Ultimate Rewards.

But, I went ahead and clicked to activate it – except…

Oh well!

Have the abundance of great rewards and mile offers jaded me a little? 🙂

Are you trying to sign-up to the offer from abroad?

I am in Europe at the moment, got the same error when trying to enroll to the American/Citi offer, managed to get it working by connecting to my home VPN, and applying from a US IP address.

Actually, I am and was but it still did that even when I had the VPN on. I will have to give it another shot. Thanks for the data point!

We get these offers all the time. They are always capped at $25. Toys, pharmacies, most recent, anything online, etc. This last one was 5% off up to $500 on anything purchased online, was naturally used for utility bills. Who can complain about that? I am certain we will have amassed more than a Dividend card yet this is just a Diamond Preferred!!!