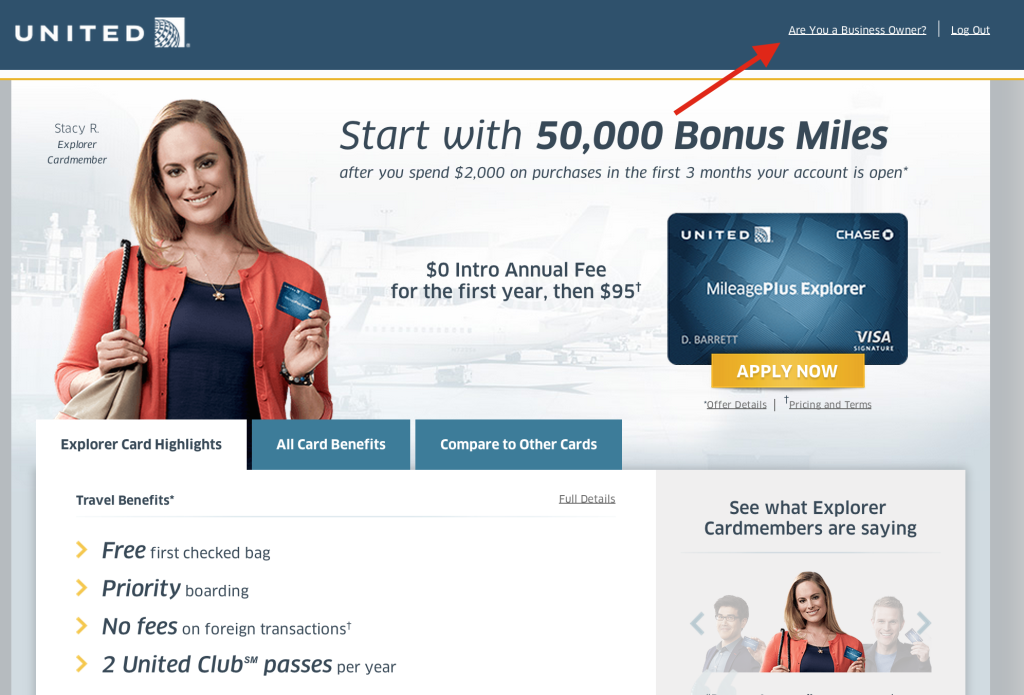

The United 50,000 mile card offer has been around for quite some time but only for a short time this year as a public offer. Otherwise, it is normally targeted. Even then, it comes and goes as a targeted offer but it appears that it has come this time yet again! However, it is targeted again. Find out how you can see if you are targeted for this great offer!

United 50,000 Mile Card Offer – Personal and Business

This offer is a targeted offer and you must sign-in with your United account information to see whether you have the regular United offer (which is 30,000 miles) or the higher 50,000 mile offer. I was targeted for the 50,000 mile offer for the personal and business card (and I currently hold the business card) and am a United 1K member. My wife (no status and no current United card) was not targeted for the offer but another family member in a similar position position was targeted for it.

– United 50,000 mile card offer (targeted)

Card Benefits

- free first checked bag

- priority boarding

- no fees on foreign transactions†

- 2 united club passes per year

- 10,000 bonus miles when you spend $25,000 in net purchases on your card each year

- 5,000 bonus miles when you add an authorized user and make a purchase in the first three months

- earn 2 miles per dollar spent on tickets purchased from united

- earn 1 mile per dollar spent on all other purchases

- miles don’t expire

Getting the additional 5,000 miles

The card itself comes with a 50,000 mile bonus. To get the extra 5,000 miles, you must add an authorized user and make a purchase in the first three months. To add that user, all you need to do is to select to speak to a customer service representative when you call to activate the card. Once you speak with them, give them the name of your authorized user and you are all set! Make sure you do not add the person as joint on the card or else it could prevent them from getting the bonus!

The Offer’s Strong Points

The annual fee ($95) is waived for the first year, which is always a good thing. And the 55,000 miles you will accrue with this offer are just about enough for a one-way business class ticket to Europe aboard United or a round-trip ticket to Europe or enough for two round-trip tickets in the US. No matter how you slice it, there is a lot of value here!

Another great thing about this card is that it has the same terms as most chase cards as of late – you can get this offer as long as you have not received the bonus from the card within the last 24 months and you do not currently have the card. That means, if you have the card right now, move the credit line to another Chase card, cancel the card, and then apply for this offer.

Also Available For the Business Version!

The business version does not offer the 5,000 mile additional cardholder bonus, but it has the same 50,000 miles after spending $2,000 in 3 month! That is a great way to double up and earn 100,000 miles with two credit card applications (you can apply for a business and personal card from Chase on the same day, but may have to call the reconsideration line on one of them).

When you login into your account (using the link above) to apply, go to the top right corner and click Are You A Business Owner? That will bring up the page with the 50,000 mile offer. But, this will most likely only show up if you were also targeted for the 50,000 mile offer on the personal card.

Summary

It’s a shame that it is targeted and I am not sure what the parameters are for who is targeted and who is not. But, this is a great offer on a good card and requires a smaller spending requirement than the Chase Sapphire Preferred which would only give you 40,000 United miles (if you transferred the Ultimate Reward points over). For one card application and some spending, you can have almost a roundtrip ticket to Europe that could otherwise cost well over $1,000. For me, that would be a no-brainer application!

If you are not targeted for the offer but still interested in applying for the card, the 30,000 mile public offer does pay me a commission and you could apply for that directly here – 30,000 mile offer.

I still hold the old MasterCard product from the old Continental days. The physical card was converted to say United but nothing else changed. Just for fun I logged into my United account and was only shown the 30K offer. However, when I clicked the “Are you a business owner” tab, it offered me the 50K. I guess it’s possible that the 30K vs 50K isn’t always consistent across the board.

Thanks, for the data point. That is interesting since I do have the business and I was offered the offer on both personal and business. Do you have elite status with United?

If I remembered it correctly, when you count your 24 months you should look at both personal and the business cards at the same time. You should not calculate them separately. Am I right?

Each card counts as a separate product. So, it must have been 24 months since you received the bonus on the United personal card (and you cannot currently hold it) to be eligible for it this time around.

Thanks! I downgraded my personal card more than 24 months ago. I do still have the biz version that I received in 10/2013. Based on your answer, I need to be brave (ha! ha!) and go for the personal again.

No worries – the terms definitely speak to a specific product and card and not a card family. If you got the 50,000 mile offer, then, yes, I would go for it. But, what did you downgrade the personal card to? If it is still a United card, which one?

I downgraded it to MileagePlus Reward which (I believe) is not available for public to apply but just a card for downgrade.

Now you got me thinking about if I am really targeted….

Here are the steps I took.

– Log into United.com

– Navigate to “Credit card partners”

– Click on the personal version. It shows 30,000 miles.

– Go back and click on the biz version. It shows 30,000 miles. Click on “Not a business owner”, now it shows 50,000 miles for the personal card! Yeah~~

Meanwhile, I saw a link “http:/www.theexplorercard.com/55” on FT. Using this link and after logging in, I DO see 50,000 miles. Just to validate, I tested the link with three FF accounts. Two have 50k. One has 30k. So, the link appears to be functioning accordingly and it is quicker and probably is more reliable than going thru the steps I took above.

Sorry for the long comment. I just wanted to show you that you could get different answers depending on what link or route you use.

[…] tip to running with miles & flyertalk […]