With the points and miles game constantly changing, it is always important to change as well. I have been hot and cold on Hilton’s program due to an inflated award chart. My loyalty is to my wallet, but their recent changes have me rethinking their program and joining Hilton’s bandwagon.

Joining Hilton Bandwagon

I have always had a rule when it comes to having a hotel card:

- It MUST come with a “free night” certificate

I put this rule in place for myself because it’s great to receive a hotel room for a greatly discounted price.

Currently, between Kristin and myself, we each have the IHG credit card and I have the Hyatt credit card. Together, that is $173 in total annual fees which will allow us to have 3 nights in nice hotels. That is about $58 per night on average. Some people have said that is ridiculous to pay that, but I always reply, “If you can find me a really nice hotel, for $50 per night, then please show me.”

The answer is you can’t.

With my rule in place, this have left out some programs in my repertoire. These include SPG (which I think is an overvalued program), and Hilton.

I have enjoyed my stays at Hilton Hotels and although I don’t chase status, I am a Diamond member for the next year. That is courtesy of my Hyatt Diamond status, which I matched from IHG Platinum :-).

Being Diamond doesn’t mean a lot to me, but if everything else is equal, price, location, etc. This could be the better option due to a complimentary breakfast. Sure room upgrades are nice, but I’m not visiting a new location for their hotel room. I feel when I had Hyatt Diamond Status, I made poor decisions. I learned my lesson from that though.

Since Hilton’s credit cards do not include a “free night” as part of their credit cards, I have stayed away from them for this reason. I am seriously considering breaking my rule for a couple of Hilton credit cards.

Why Break my Rule?

My favorite hotel chain is Hyatt, but their footprint is quite small. Hilton has about 7 times more properties than Hyatt, which makes it quite easy to find one when you need one.

I enjoy my IHG credit cards for the free night, but I feel the service there is mediocre. Within the IHG chain, I have received the best service at Holiday Inn Express, which are typically lower on point cost.

Although we like staying at Airbnb for longer stays, hotel points are a great option for short trips.

The other day, Hilton rolled out their new changes, some good, some bad. For me, I thought the best change they rolled out was the ability to pool points with up to 10 other people (which starts in April).

That one change has me on the fence to break my rule when it comes to hotel cards. This could be a huge factor in reducing my travel cost.

Inflated Chart

One of my biggest complaints is the ridiculously inflated chart Hilton has, well used to have. As much as I like an award chart for transparency, the reality is this could be a growing trend. Even with an award chart, you were happy to receive a value of 0.7 cents per point when it came to Hilton points.

On the flip side, Hilton points are possible the easiest hotel points to earn. Start adding the fact you can pool points together, you can earn a crazy amount of Hilton points for very little.

Just from credit cards alone you can earn a boat load of points. Hilton has 4 c co-branded credit cards:

[wpsm_comparison_table id=”11″ class=””]Just strictly looking at the point bonuses, not the weekend certificates. You can earn 250,000 Hilton points from 3 cards and a $6,000 spend. That is earning Hilton points around 42 Hilton points per dollar rate.

If you have a significant other this doubles that amount. Not to mention if you have other members of your family who let you open cards.

Once you get out of the direct co-branded cards for Hilton, there are still so many options.

I’m not saying it is the best use of your points, but Hilton points also transfer from Membership Rewards and Thank You Points at a 1:1.5 rate. Occasionally these programs offer transfer bonuses as well.

On top of that, there are other cards, such as the Barclay Hawaiian Airlines credit card and Bank of American Virgin Atlantic that also transfer over to Hilton at 1:1.5 rate.

In the end there are hundreds of thousands or even millions of Hilton points you can earn with these sign up bonuses alone. Not to mention if you actually use a co-branded card to earn points ( I don’t recommend that).

Use of Cash and Points

One of my favorite options to use of Hyatt points was cash and points. This benefit allowed me to extend my points which overall gave me a reduced rate on my travel.

The method I always took, was I could have 4 nights for $0 out of pocket or have 8+ nights with a couple hundred out of pocket. Overall, I would prefer the reduced rate and extend points than have less “free nights.”

In playing around with their new site, it seems to have a lot more points and cash options as well. Even though this isn’t nearly as good of a value when compared to Hyatt, having more redemption options is always a benefit.

5th Night Free Benefit

With potentially earning a boat load of Hilton points from sign up bonuses and pooling. This benefit could add even more value to joining the Hilton bandwagon.

Depending on my stay and the amount of points needed, booking 5 nights for the price of 4 is a great benefit.

Hilton does describe what would occur if there is a difference in points for the nights you book. For example, if you booked 5 nights, with the point breakdown of 40,000 points each night for 3 nights, then 50,000 points for 2 nights. Hilton will take the average per night and subtract it from that total.

This could work in your favor or against it. If the last night was 50,000 points you wouldn’t save 50,000 points for that last night. On the flip side if the 5th night was 30,000 points and the previous 4 nights were 50,000 points this works out in your favor. Is it perfect? No, but it seems like a far and easy way to manage this.

Stacking Savings

Being able to stack savings is one thing I really enjoy. It really doesn’t matter what it is, but especially for travel.

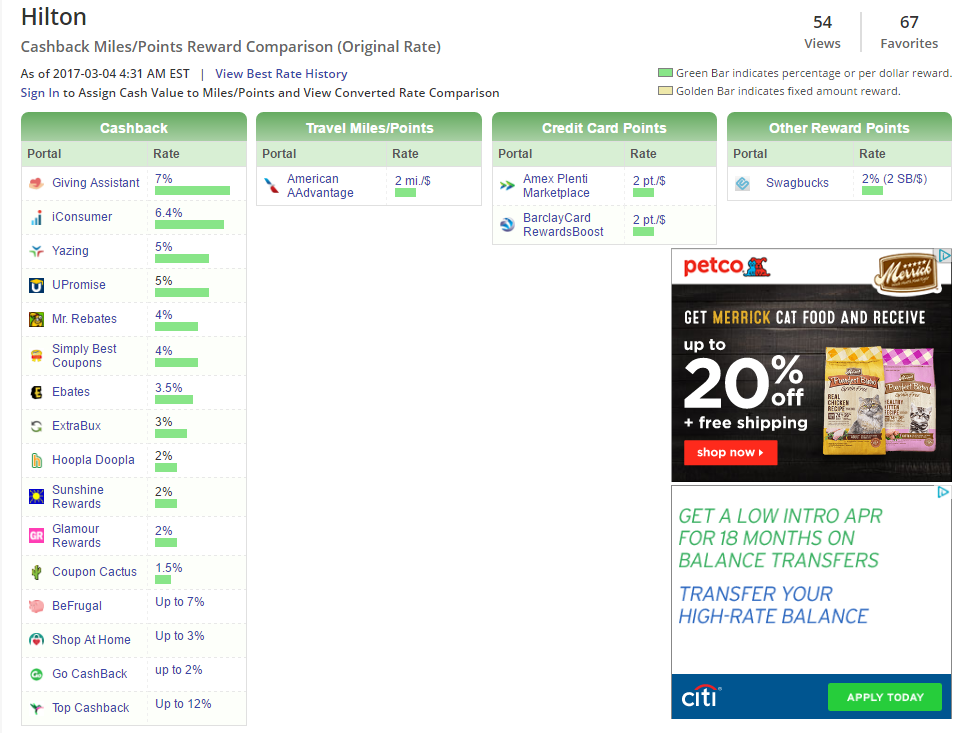

Looking at CashBack Monitor this is the current payout for Hilton:

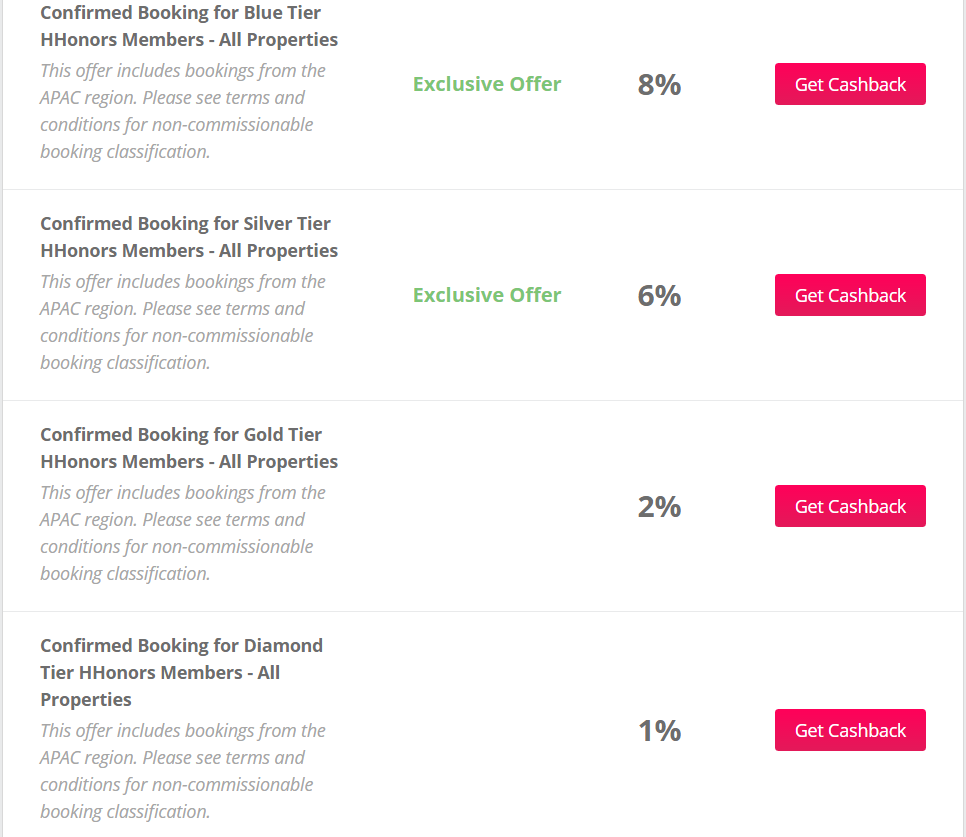

At a minimum you can earn 7% cash back through Giving Assistant. When I opened Top Cashback for their up to 12% I saw this:

It seems a little backwards that the top tier member earns less, but it I guess if they have status you probably have them roped in anyways. There is no need to entice someone.

Plus when you start thinking of all the Amex Offers that seem to pop up for Hilton you can really start stacking these savings!

In my ideal world all these things will happen, now I haven’t tried this yet, but I would think it would work.

You would use a shopping portal, such as Giving Assistant, use your points and cash option. In addition to an Amex Offer to save yourself more on the cash portion of your stay. Again, I don’t know if that will work, but I believe it would. If you have a data point for this, leave a comment below.

Conclusion:

Hilton’s changes, although are not perfect, they did make some changes I like. You must be willing to change as this game changes or you could be losing out on “free” heavily discounted travel.

Although the Hilton credit cards fail to meet my rule for hotel cards, they do allow for point pooling. This one benefit can easily save me lots of money for my hotel stays. Since this is important for me, I might be willing to break my rules for Hilton now.

Do you have any rules when you open credit cards? What are your thoughts on Hilton’s point pooling?

Don’t forget to Like me on Facebook, or Follow me on Twitter. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!

Methinks you may be a bit confused:

First you say,

“Since Hilton’s credit cards do not include a “free night” as part of their credit cards, I have stayed away from them for this reason”

Then you show:

“Citi Hilton Reserve gets 2 Weekend Nights”

Then you say again,

“Although the Hilton credit cards fail to meet my rule for hotel cards…..”

???

Yes, I noticed that too. Although I think Dustin had in mind an annual free night, rather than a one-time bonus. But the Citi Hilton Reserve awards one weekend night (F, Sa, Su) every year that you have the card and put at least $10,000 on the card. Not “free”, unless you’re using it for expenses that are already budgeted, but still a decent benefit.

Hey Jason ,

I guess I wasn’t too clear writing it! It made perfect sense in my head :-p.

The $10k spend doesn’t appeal to me personally as I’d prefer to put spend on other cards. I agree if you actually spend on it. It’s not a bad benefit.

Thanks for reading!

Dustin

Hey Mojo,

Sorry for the confusion! I was speaking about the annual free night vs the sign up bonus of 2 weekend nights.

My rule has a “free” annual night like IHG or Hyatt. The bonus of 2 free nights is nice, but personally it doesn’t give me long term benefits. That’s why Hilton has been left off my list.

Hope that clarifies! Thanks for reading!

Dustin

I sorta like Hilton but I’m an IHG loyalist that also prefers Marriott. That being said with Hilton I still think the cards are churn and burn, not keepers like IHG’s card.

Hilton has been giving out Diamond status like it’s candy and also throwing points bonuses out like 3x, etc. Right this minute I’m in a Hilton Garden Inn. I’m getting 2x points from whatever bonus plus the 3x for using the App to book promo. Then I booked a 2x point bonus package on the reservation because it was only a few dollars more. On check in my Diamond offer was 750 points or free breakfast. I personally find Garden Inn breakfast a pain as I’m usually in a hurry so I opted for the 750 points. I’ll net about 6 to 10k in points on this stay plus I double dip on airline miles which will get me a few hundred AA or Avios (can’t remember which I’m using right now). So not bad. Trouble is if I would have booked a similar IHG HIX stay with a bonus package and my Spire Ambassador status I would have earned about the same number of points (no airline miles) plus I would have gotten at least 500 welcome points and free breakfast that is an easy eat and run style. Not to mention that I wouldn’t have to pay $1 for a K-cup in the lobby for coffee at HIX.

The other thing to keep in mind is if you book Hilton points+cash you’ll pay taxes and resort fees unless you book with all points.

Hilton is to hotels what McDonald’s is to fast food, while Hyatt is more like Wendy’s (i.e. I like Wendy’s better than McD’s, but it’s far easier to find a McD’s when you’re hungry). And Hilton points aren’t worth much, but are easier to earn.