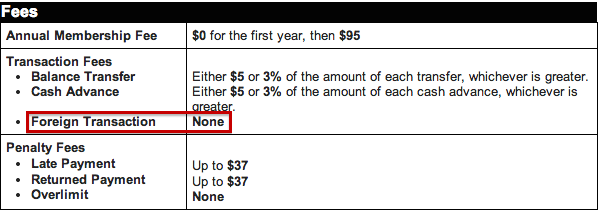

Yesterday marked the first day of American Express not passing along foreign transaction fees to Delta Amex cardholders. Foreign transaction fees have long been something that American Express would not shed except for their high-end cards. On the other end of the spectrum, Chase has been issuing most of their cards with no foreign transaction fees.

The foreign transaction fee is a fee of 3% that is passed on by the card issuer to the cardholder when the card is used in a foreign currency. That’s right – you do not even need to be outside of the US to be hit with a foreign transaction fee. If you purchase something from a vendor that charges in a currency other than US dollars, you will be hit with that fee. Having that fee assessed has always been very limiting to American Express members. I have been overseas for the past 10 months and my Delta cards have been back in the US. There is no reason for me to take them with me because there is no way that I get anywhere near 3 cents per mile value out of my Skymiles (which is what the 3% fee works out to cost).

However, as of May 1, that foreign transaction fee is no longer on Delta American Express cards. That is good news for the Delta American Express cardholding faithful – all 5 of them. 🙂 Actually, I have used my card a fair amount as I earned my Medallion Qualifying Miles with the Reserve card (15,000 MQMs for $30,000 in spend in a calendar year). Being able to use that card anywhere in the world is now a useful perk. Now, if only more places in the world would accept American Express…

With this consumer-friendly change, it would be nice to see American Express do the same thing to their SPG card. I never use my SPG card, even for hotel stays, abroad because of that fee. SPG points are valuable but not that valuable that I want to pay that much for them. Hopefully, this will be the first move of many for American Express. They have lost a lot of ground to Chase, Barclay, and Citi by charging that fee in the past – is this change too little too late? Especially with the increased annual fee on their Delta Platinum card from $150 to $195 (which also went into effect May 1).

Does this change effect how you will use these cards going forward?