It has been a rough year or so for American Express as Chase and Citi had been nipping at their heels in the rewards and benefits department for a while. In fact, almost a year ago was when Chase just crushed it in the premium card arena with the launch of their Chase Sapphire Reserve – and a very expensive launch it was for Chase.

Did American Express Create A Winning Card?

In my opinion, for far too long, American Express had been resting on their laurels of what they had accomplished with their various products and the credit card/charge card marketshare over the years. Many people have described the best card for all purchases as being the Amex SPG card – but that is not due in any real part to American Express. In fact, they don’t even offer an real bonuses on the card for spending. The real benefit is with the SPG program itself.

Another great card has been any version of the Platinum card but even their refresh of the Platinum personal card was more about raising the annual fee than giving great value to cardholders across the board. They did a great thing with their 50% rebate on Pay with Points for the business Platinum card – before pulling it less than a year after it launched. They have also had some creative category bonuses on their Premier Rewards Gold and Business Gold Rewards as well but nothing that has been a huge reason to jump on the Amex bandwagon.

The Great Blue Business Plus

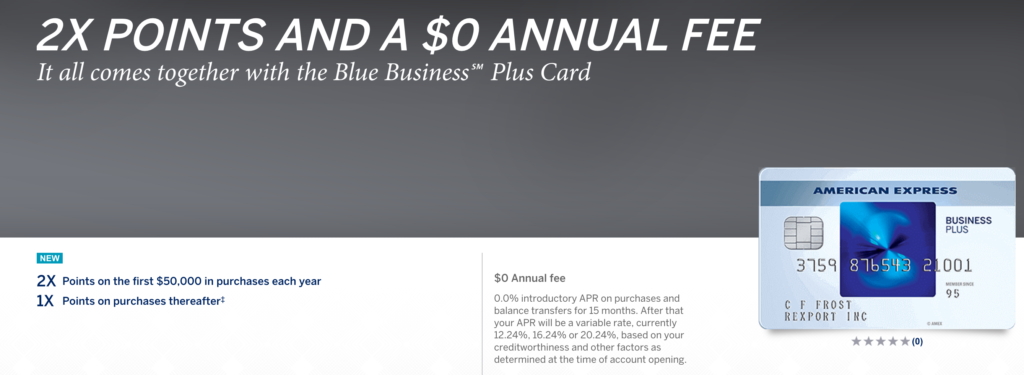

Until they launched their new business card, the Blue Business Plus, a little over a month ago. This card presented a lot of great features, features that were likely only “great” due to the current state of the credit card rewards market (card bonuses are more difficult to come by for veterans in this game, manufactured spending has been hit hard, etc). Here is what the card offered right at launch:

- 2X points on everything (up to $50,000 in a year)

- A hybrid card (read this post for more details)

- A no-fee Membership Reward earning card (read this post for why that is great)

Shortly after launch, like in a few hours, the card came down with a 20,000 Membership Reward point bonus. Prior to the bonus, many people were already interested in signing up for this card for what it offered. With the addition of 20,000 Membership Reward points, it was a lock.

And it must have converted some big numbers! I don’t think I have ever seen a card issuer pull a sign-up bonus so fast! There is not any sign-up bonus available now this card at this time now . What happened?

What Happened to the Bonus?

I have heard from a couple of people that Amex did receive a lot of applications and, as a matter of fact, it appeared that they were not even doing a hard pull for this card on the applicants’ credit profile. Not sure why that was but it probably meant there were a lot more approvals by that method since it would have only gone against what American Express had on the applicants (as opposed to being based on other credit factors).

So, where does it stand now? I think the card was worthy by itself already, especially without a hard credit pull. So, I still think the card is a good one without a sign-up bonus. But, Amex does not charge an annual fee for a card that feeds into their lucrative Membership Rewards system. That had to cost them a bit.

What It Cost Amex

Here is what it was costing American Express with this new offer, or maybe what they were losing:

- $100-150 for affiliate fees

- 20K points which would cost them at least $200 if used with Pay with Points

- $0 annual fee

- Plus, they were offering interest fee for 15 months – that meant it was even more likely that everyone would meet the minimum spending quickly and there were no interest fees for them to collect for more than a year!

In other words, a great card for us but it was costing Amex. They have now even pulled the link that was still offering the 20K points and wasn’t paying bloggers/publishers a fee for it!

Oh, and one more thing – it appears that this card has not carried any of the usual Amex Offers so it could be another way they are cutting some costs.

Takeaway

I am actually glad to see American Express making some bold moves like this. A couple of years ago, we would not have been so excited about a double point card capped at $50K per year but given how everything is, that is a really effective offer for many. Not only that, but it gives many people a card to use and park their Membership Reward points in – without paying an annual fee.

I think this time, though, this card was even more popular than even Amex thought it would be. Hopefully you got in on it! But, if not, I still think the card is pretty strong with its main features – even without a sign-up bonus.

Did you get the American Express Blue Business Plus card? What do you think of it?

I can’t use Amex @ Costco anymore. They dont accept it any longer. There have been other major stores that either don’t accept it or charge 30 plus cents. Not good. Phoenix, AZ.

Do you forget that the top management got away from amex and where do you think they end up at ? chase bk game changer ! These companies trade each other employees you never know who the game changers are right?

Management Strategy. get it right and you are in for the long run.