Charlie: This is a special post for me as it is the first guest post ever on Running with Miles! I have gotten to know Dustin a bit as of late and have really enjoyed his blog and writing style (and he is a fellow runner!) so asked if he would be willing to do a guest post here. Check out his blog – Waller’s Wallet – to keep up with him! He is also on Twitter – @wallerswallet

I just want to say thank you to Charlie for letting me be a guest on his site! When Charlie asked me to guest post on his site, I was excited to do so. I really enjoy comparing credit cards and since the game is always changing, I think the top card changes as well. The top card ultimately comes down to what works best with your goals. So, let’s get to it…

A couple of months ago, I dethroned the Chase Sapphire Preferred as the “Top Travel Credit Card,” when I thought the Citi Premier was a superior option. Recently, American Express made some favorable changes to the Premier Rewards Gold charge card. They adjusted some bonus categories, added an airline credit and even took away those dreaded foreign transaction fees (about time!). With all these changes, has the American Express Premier Rewards Gold done enough to regain top form and best the Citi Premier?

Credit Card Battle: Citi Premier vs American Express Premier Rewards Gold

American Express Premier Rewards Gold: My Review

[table “” not found /]Credit Score Needed:

According to Credit Karma, individuals with the Citi Thank You Premier card have an average credit score of 793 with a low of 745 and a high of 819.

A person with the American Express Premier Rewards Gold the average credit score is 726, with a low of 676 and a high of 804.

I find it interesting that Credit Karma has a such a high average credit score for the Citi Premier, since creditboards.com has many scores in the low 700’s and a handful of scores in the 600’s.

I am confident if you applied for the Citi Premier with a credit score over 700 it would be good enough for an approval. If you credit score is under 700, I would advise against applying for any reward card like these. There are credit cards available to improve your credit and eventually play this game.

Current Sign Up Bonus:

The Citi Thank You Premier has a 50,000 point bonus after spending $3,000 in the first 90 days. I value Thank You points at 1.7 cents per point, making the 53,000 points (could be more from depending on your spending) from the bonus worth about $901.

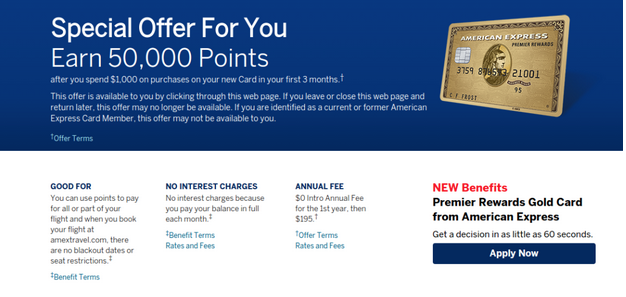

The American Express Premier Rewards Gold has a public offer of 25,000 points after a $2,000 spend, but if you set your browser to Incognito, you will find a better offer of 50,000 points after spending only $1,000 in the first 90 days. I value Membership Reward points at 1.7 cents per point, making the 51,000 points (could be more from depending on your spending) worth $867, but…..

In addition to the 50,000 points, you will also receive $100 airline credit. Since the airline credit is based on a calendar year, you will get this twice before paying an annual fee, making it worth $200. Making the total sign up bonus worth about $1067.

Winner: American Express Premier Rewards Gold. The airline credit and lower spending requirement pulls American Express to victory here.

Annual Fee:

The Citi Thank You Premier has a $95 annual fee and that is waived for the first year.

The American Express Premier Rewards Gold has a $195 annual fee and that too is waived for the first year.

Winner: Citi Thank You Premier. The $100 lower annual fee doesn’t need any explanation, right? Some will argue this saying the $100 airline credit on the Premier Rewards Gold makes this a tie and you might be right, but if you gave me $100 and I gave you a $100 gift card, you still paid for it right?

Earning Rates:

I know this will change based on your spending needs/habits, but to keep this equal, I will look at the average American spending based on the Bureau of Labor Statistic:

[table “” not found /]* I included the minimum spending requirement for the totals, but used 1 point per dollar for both cards

The Citi Thank You Premier earns 3 Thank You points per dollar spent on travel, including gas, 2 Thank You points per dollar spent on dining and entertainment, and 1 Thank You point on all other purchases

The American Express Premier Reward Gold earns 3 Membership Reward points when you book airfare directly with the airline, 2 Membership Reward per dollar spent when you use it at US gas stations, US grocery stores, and US restaurants. Remember this…

Winner: Citi Thank You Premier. I gave ranges for American Express, there is no way to know if you’ll spend all your travel money on airfare or hotels and if you spend all your money in the US. Even if you did, the Citi Premier out earns the Premier Gold Reward.

Foreign Transaction Fees:

Both the Citi Thank You Premier and the American Express Premier Gold Reward have no foreign transaction fee

Winner: Tie

Domestic or International Use:

It is great that American Express finally removed foreign transaction fees from their card that is going to cost you close to $200 to have, but this is still not a card I would use internationally. If American Express want people to use this card outside of the US, they need to make the bonus categories extend to other countries. The Premier Gold Reward is the better option for groceries if in the US, but that is about it.

The Citi Premier doesn’t restrict their bonus categories for international use and personally I’ll be using my Premier when I head to Europe in a couple of months. The earning rate makes this card a great option for domestic or international travel.

Winner: Citi Thank You Premier. Not having to worry about losing out on points when you’re traveling internationally should be a no brainer. Clearly, Citi understands this and American Express lacks that understanding.

Reward Programs:

The Citi Premier earns Thank You points and they can be transferred to 11 airlines and 1 hotel program

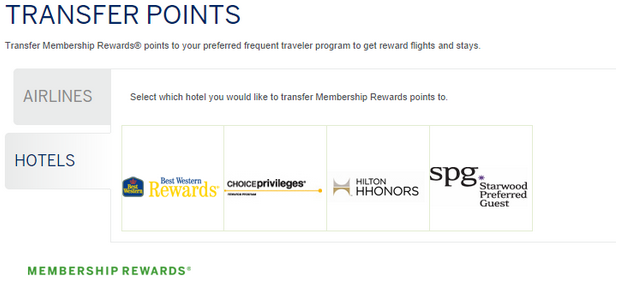

The American Express Premier Rewards Gold earns Membership Rewards and they can be transferred to 16 airlines and 4 hotel programs

Winner: Membership Rewards. Membership Rewards has a greater number of transfer partners, but I don’t think it is a large margin of victory here.

You can see there are a few overlapping transfer partners; Asia Miles, Flying Blue, Virgin Atlantic, Singapore Airlines and Hilton Hotels. Both of these programs have great alliance options as well. You can use Singapore miles to book United flights for less miles, you can fly Delta with Virgin Atlantic miles and there are other alliance partner options that make these both very valuable programs.

Citi lacks a direct domestic transfer partner and they should address this. You can use your miles and book with alliance partners, but I think to move up in the world of travel currency, they really need a direct domestic transfer partner.

This is where American Express does a pretty good job, even if the all the transfer rates aren’t 1:1. You can use Virgin America, Delta (there is still some value here), British Airways, Jetblue and Hawaiian airlines if you are flying to Hawaii/between islands.

My biggest complaint isn’t their airline partners, but I do think both need better hotel partners. Hilton points are extremely inflated and even at a 1:1.5 transfer ratio you would still need to transfer a lot of points for a free night. There is some underrated value in Choice and Best Western, but most people are saving their points for a week long vacation at the Best Western in Rome, right? SPG is a terrible 3:1 transfer ratio and personally I’m not a fan of their reward program.

Both of these programs offer occasional transfer bonuses to certain partners, which can be very valuable if you were planning to use that particular partner.

**Currently, Citi is offering a 25% bonus if you transfer your Thank You points to Virgin Atlantic.**

One other consideration, American Express will not allow you to combine others (like spouse/partner) into one account. You can share your points with them, but won’t be able to pool your points. Citi will allow you to transfer your points to others (like spouse/partner), BUT they will be give a 90 day expiration date, so make sure you plan to use them if you do combine your points

Redemption Options:

Citi allows you to redeem your points for credit statements at 0.7 cents per point and gift cards for 1 cent per point. If you were to redeem your Thank You points through their travel center, you will redeem your points at 1.25 cents per point. You can also transfer your points to one of their 12 partners and redeem for even more value.

American Express allows you to redeem your points for charges at 0.6 cents per point, gift cards for 0.5 cents to 1 cent per point and statement credit for 0.6 cents per point. Again, American Express needs to address this…

If you redeem your points through Amex Travel, you will redeem at 1 cent per point when you book airfare, but if you use your points for a hotel redemption you’ll redeem for about 0.7 cents per point.

**Make sure to price check other sites before using Amex travel or the Citi Travel center, their prices can be much higher than booking on other 3rd party sites or even directly with the hotel**

Winner: Citi Premier. Booking through their travel center you redeem at a better rate than you do with American Express.

Other Considerations:

Both Citi and American Express offer great product protection when you purchase items with their cards.

I really enjoy Citi’s Rewind program. If you’re not familiar with it, you purchase an item with your Citi card and you register it on their Rewind site. They do all the work for you and if they find a better price than what you paid for it, they refund you the difference. Totally worth the 5 minutes to register your purchases!

The best perk I feel from American Express is their Amex Offers, these bad boys can really help you save money on items you would purchase anyways. Their offers seem to be getting better all the time and these alone are a good reason to have any American Express card in your wallet!

Does the American Express Premier Gold Reward top the Citi Premier?

American Express has made some really solid improvements to their card, but I don’t think they have done enough to over throw the Citi Premier. Even though American Express has more transfer partners, Citi overlaps with many of them and has access to many airlines within their respected alliances. The Citi Travel Center offers a better redemption option than the Amex Travel Center. American Express needs to expand their bonus categories and not include only the US if they want people to use their card when traveling abroad.

At this time, I give the Citi Premier the “Top Travel Credit Card” ranking.

What do you think, do you agree? Do you like American Express’s recent changes to the Premier Gold Reward

Don’t forget to Like me on Facebook, Follow me on Twitter and subscribe to my blog. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!

Thank you again Charlie for asking me to guest on his site, I really enjoyed it and hope you all enjoyed my article as well.

I realized this is my 50th blog post and celebrate, I’ll be giving away 2 $10 gift cards to Amazon. One will be through Twitter, the other will be through Facebook.Follow my blog then Follow me on Twitter or Like my Facebook page and leave me a comment telling your favorite trip and what made it special. I’ll select 2 winners on 8/17 and reach out to get you your Amazon gift card.

Dustin,

How do you value the Amex Statements that they offer. This can be a difficult value to peg since they rotate or may not apply; or did you propose the values under the pretense that the individual would have another Amex(Asking as I am considering the cards and already have several Amex cards)

Hey Mike,

I think youre speaking about the Amex offers? I agree, it is hard to assign an actual value to the Amex Offers. There seems to always be an offer I can take advantage of, whether it’s gas, items for the house or gift cards for future use. It really seems to vary as far as value. But on average, id say im saving about 15-20% minimum when I use an Amex offer. I have saved hundreds so far this year though on items I planned to purchase anyways.

I didn’t assume multiple amex cards for people, but the value of these offers can easily be multiplied if you have an AU or multple amex cards.

Let me know if that answers your question. :-).

Dustin

Dustin — Thanks for your views. However, a somewhat even more persuasive case can be made for the Cit Premier over the AMEX PRG on 2 of your spend categories.

1). Although both cards state that they charge no FOREX fees, you will see from a simple search that AMEX’s Forex fees are set consistently higher than the inter-bank Forex fees that the banks use — therefore, there still is some charge passed on to you when using your FOREX fee free AMEX overseas as opposed to a Forex fee free bank card, such as the Citi Premier — it is just that AMEX still somehow calculates such charges to be more in costly than the comparable bank cards.

2). Although you list your travel charges as perhapsreaping the same number of points using the AMEX PRG vs. the Cit Premier, for most people they would never hit such a number, as the Citi Premier will double hotel charges and the AMEX will not. More importantly, many of us live in urban areas and additional charges for parking or mass transit must be factored into the mix. The AMEX card provides no bonus whatsoever for this type of spend, whereas the Cit Premier (and the Chase Sapphire) do.

Consequently, although AMEX has stepped up its game with this new card, it still fall far short than its competitors.

Although I agree that it is nice to have those AMEX Offers and SBS, there are plenty of no-fee AMEX rewards cards that can fill that void, such as the AMEX Everyday card and the no-fee HHonors AMEX card to name but a few. With authorized users, that can easily double the number of those cards, as well.

AMEX still has a lot of innovating to catch up with its rivals.

Hi Horace,

Thanks for your comment. I enjoy interacting with readers!

The banks inter-bank fees are going to be there with or without the FTF and even if they are slightly higher than other banks, it wouldn’t be enough to be deal breaker (IMO). The 2.7% or 3% fees add up much more than the inter bank fees. So, even though it could be slightly more, I feel it is negligible, but again that is me.

The chart was based on the average spending of Americans, this will vary from each person’s actual spending. I spend way more on gas, than I do on travel and groceries and I’m sure your spending is different than mine as well.

The range was to show the min and max amount of points you could earn on travel with PRG. It is unlikely that you spend over $6k directly with the airlines, but some people might. I agree the Citi Premier is best for earning on travel charges, it is 3x on hotels though (that’s why I still think it is the champ) :-).

I’m not sure you can say most have additional charges for parking or mass transit, that will be individualized. I rarely pay for parking and pay toll charges one a month, but you might. So it is definitely something to keep in mind when picking a card. Again another individualized factor

You are correct, there are a few card with no annual fee and for some those might be great options, but I was looking at the PRG in this comparison. For earning MR points, I feel EDP is the best one out there. I gladly pay the $95 fee for the extra earning potential with my EDP and the AMEX offers on it have already paid for itself.

We agree that Amex still needs to improve to be a competitor with some of these cards coming out.

Thanks again for your comment and reading!

Dustin,

Do you think Citi Premier tops over Prestige and Chase CSP as well? CSP has 2x on dining as well and 3x on travel, isn’t it?

The reason I am asking is because now I have Chase Ink, CSP, and Citi Premier.

My annual fee on CSP is coming up, and I am thinking of either cancel or downgrade it, but with Chase’s recent negative changes that they really getting strict on approving credit cards application, I am scared to do so. On top of that, CSP is my cc from Chase that has the most credit limit (over $20k). I get used to always use CSP for travel and dining because I like UR points. Although now I start to use Premier as well since I got it 2 months ago.

If you were me, will you downgrade or cancel the CSP, if you already have Ink and Premier, considering the factors I outlined above?

Hi John,

When it comes to the Prestige, the annual fee is much higher and you would get some good benefits for the first year. If you were to use the 4th night free, free golf and airport lounge access, and airline credit it could be good. If not, I’m not sure it would be. For me, it is too rich for my blood and I wouldn’t maximize all the extra benefits, so for me it is not worth the fee :-).

I currently put my travel on my Premier because 3x awesome for travel earnings.

The CSP is 2x on dining and travel (does not include gas), the Ink is 2x on gas. Do you have the Ink Plus or Ink Cash? the Ink Plus would allow you to transfer your UR points like you would with your CSP. The Ink Cash does not. If you have the Ink Plus, I would downgrade CSP to Freedom.

Here is my article comparing the CSP to Premier: http://www.wallerswallet.com/2015/06/22/credit-card-battle-chase-sapphire-preferred-vs-citi-premier/

Here is my article looking at keeping or canceling the CSP, I did receive a retention offer on my CSP, so it doesn’t hurt to try 🙂 : http://www.wallerswallet.com/2015/07/06/my-retention-offer-on-my-chase-sapphire-preferred/

If you decide not to keep the card, I would downgrade to the Freedom, instead of canceling. The 5 card rule definitely has many people, including myself nervous about canceling Chase UR cards (mixed data on co-branded cards). If you use the card enough and like the ability to transfer your UR points, you have to ask yourself, is paying $95 worth having that ability. Especially with the other cards out there and for me, it was not :-). Hope that helps!

Dustin

Awesome, thanks Dustin for the advice and the link to your primer! I will check it out! and yes I do have Ink Plus.

Ink Plus doesn’t have foreign transaction fees and its 2x bonus categories in dining also valid when using it internationally (e.g. in Europe and Asia) isn’t it?

Hi John,

The Ink plus is 2x on gas and hotel, not dining but does not have FTF.

Dustin

Thanks, I just checked your blog and it is awesome! you are so lucky to be offered a retention offer of 5k points!! As far as I know, it’s very rare for us to be offered a retention offer for CSP, even I HUCA many times, they still told me no retention offers available. I might have to downgrade to Freedom.

I also stumbled on this article and there are actually many lesser known benefits of CSP:

http://thepointsguy.com/2015/08/lesser-known-sapphire-benefits/

But if you read the comments, people say that there is another version of Freedom which is Freedom Visa Signature, which less known to public….with this Visa Signature version of Freedom, it have same benefits like baggage or trip delay, etc. just like CSP….without annual fee. Do you know about this one and what do you think?

Hi John,

Thank you very much for your kind words!

As far as I know, all Freedom’s are Visa Signature cards. When I called Chase, I told them my annual fee was coming due and I’m not sure it was worth it anymore. I would try it one more time to see if the give you any retention, if not, downgrade to the Freedom. Your Ink Plus are Visa Signature as well 🙂

If you look at your Ink Plus benefits, it says Primary Auto coverage as well. https://creditcards.chase.com/ink-business-credit-cards/compare-cards

As far as TPG article… your Citi Premier and Ink Plus have Chip and signature technology, both have no FTF, your Ink Plus says Primary auto coverage and your Premier earns 3x on travel and 2x on dining…

You’ll lose some UR points, but you’ll earn TY points which I find to be very valuable. It all depends on your goals as well…I think UR are great for Hyatt and United and possibly Southwest…You can book United with Singapore Miles and Citi, Chase and AMEX all have Singapore as a partner, so you have access to United flights 🙂

Your Citi Premier is a World Elite MC, https://www.mastercard.us/en-us/consumers/features-benefits/card-benefits.html. The benefits of those are very similar to the benefits you’ll receive under Visa Signature.

When you see that your other cards have those benefits, those 5 benefits of the CSP, don’t seem so special after all :-).

Hi Dustin, another Dustin here. Would really like to see the competition between Citi Premier and AMEX everyday preferred. I think those are the two best cards fro earning power.

Hey Dustin (awesome name!),

I think the EDP and Citi Premier are great complement’s to each other. The big question would be, do you want 3x TY points or 3x MR points :-). I really like that combo of cards! Great earning power!

Thanks for reading!

Dustin

[…] Gold Card is valuable for those who shop a lot at grocery stores, I think the Premier is the better point earner for the average traveller. (I’d just rely on another card like the Premier Rewards Gold Card or Everyday Preferred so […]