Banks can be funny in how they portray themselves. On one hand, we have a bank like Chase that constantly advertises their credit cards and what types of enjoyment can be had with their rewards program. On the other hand, we have Chase warning people that if they spend money for the sole purpose of earning points, they may suspend your account or close it. Really?

Chase Wants You To Charge Things – But Not Just For The Points

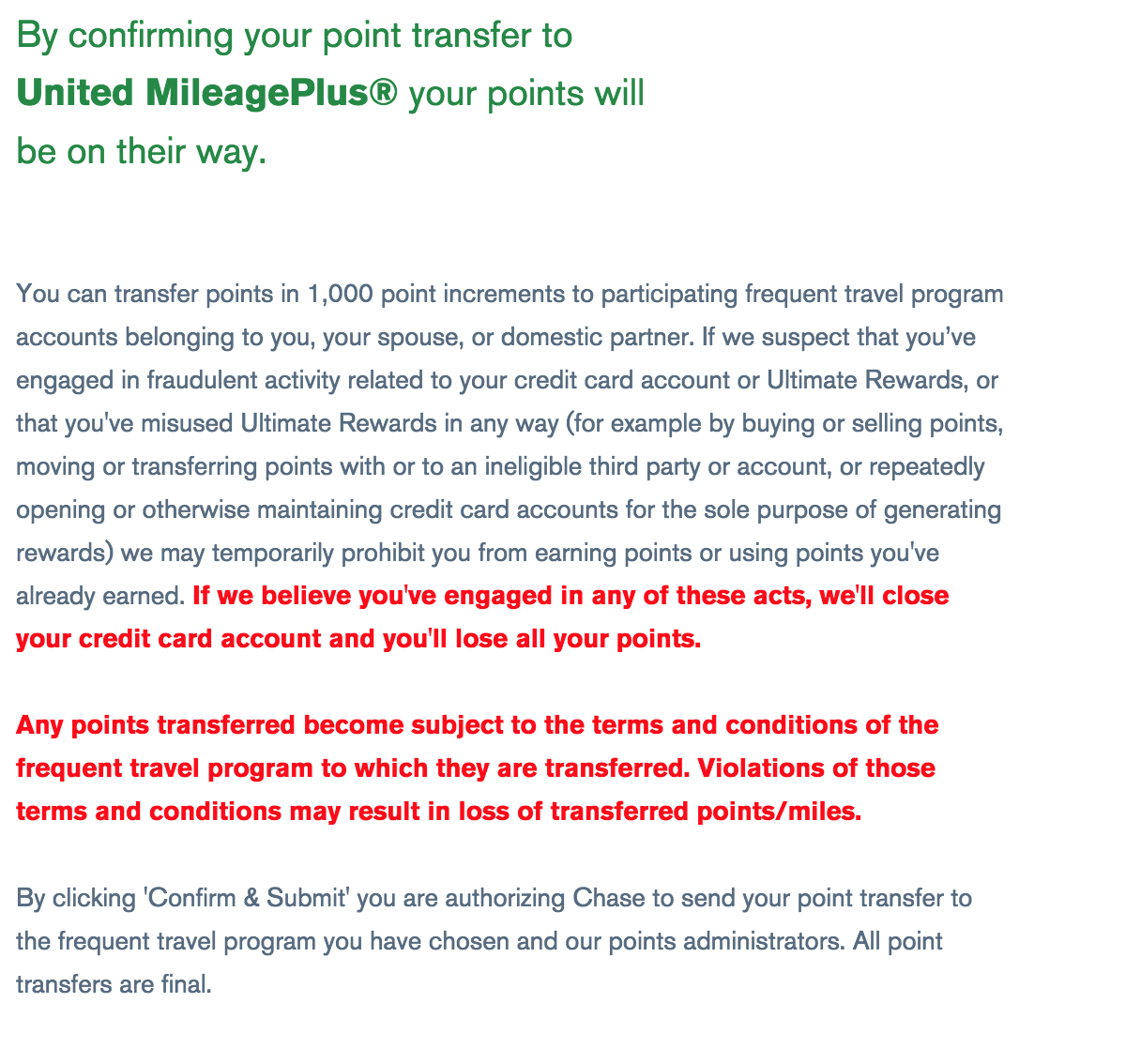

Chase has evolved with their terms on their Ultimate Rewards portal over the last year or so. While they use to include a statement that you could only transfer points to you/spouse/partner, now they make you acknowledge it and accept it while throwing some more bolded language in the mix. This has been there now for a while but when I was transferring some points the other day, I realized how crazy it sounds.

Chase’s Language Regarding Ultimate Rewards

If we suspect that you’ve engaged in fraudulent activity related to your credit card account or Ultimate Rewards, or that you’ve misused Ultimate Rewards in any way (for example by buying or selling points, moving or transferring points with or to an ineligible third party or account, or repeatedly opening or otherwise maintaining credit card accounts for the sole purpose of generating rewards) we may temporarily prohibit you from earning points or using points you’ve already earned. If we believe you’ve engaged in any of these acts, we’ll close your credit card account and you’ll lose all your points.

The bolding is theirs and points out some interesting language on their part. What we derive from that is 1) if you open cards repeatedly for the purpose of points or 2) maintain a credit card for the sole purpose of generating rewards, they will close it if they believe that is what you are doing.

So, raise of hands, who opens Chase cards for the points? That is kind of what Chase is trying to get you to do by marketing it that way! But, we know they are against the churning (opening and closing of cards for points) yet they have recently okayed it in their terms for you to officially get miles/points again after not having received the bonus in 24 months. They want you to open credit card accounts – they just don’t want you to be doing that with many cards just for the points.

Then, we have the second (and more ironic) part – maintaining credit cards for the sole purpose of generating rewards. I know with cards like the Chase Sapphire Preferred, the reward aspect is a large part of why I have the card. A very secondary reason is the protections offered by the card (rental insurance and more) but the primary reason most people have the Chase Sapphire Preferred card is for the rewards. Yet, if Chase believes that you have the cards for that main reason, they can close your account and take your points away. Since points are earned by purchasing with the card, is Chase saying that they do not want you to spend with the card?

Obviously, this language is in place to protect Chase if they want to close the accounts of those who game the system a bit – I will not even speculate here what they may consider that to be. 🙂 I do find it funny that they use such language to articulate their point. They want you to get their cards and they market them to you via their rewards program. But, if that is the only reason you get and maintain the cards, they could close you down if that is what they believe. If they suspect that, they can temporarily prohibit your accounts.

Interesting way to attract and then keep customers, hmm? 🙂

A little off the subject, but still related is how Chase has changed the online rewards mall to something that barely functions. They took away the ability to search by product, now you have to search by store, page after page. It sucks and the changes were obviously aimed at making it more difficult to earn rewards.

Also ironic that beside this post is an ad for a Chase Visa (the United card.) This is not a swipe at the blogger but further to the irony that Chase knows full well what this game is. Have you ever probed with anyone at Chase, as one of their affiliates, just where they draw these lines?

That is actually part of our ad network and not an affiliate ad. Chase dropped me from their affiliate network about a month ago because I was not converting enough applications. But, you make an excellent point about that!