Chase has bumped up their bonuses on two great business cards through May 25. One has increased $100 (or 10,000 points) and the other has gone up 10,000 points. Either one may be great for your award needs and would make a great addition to your wallet. Both of these cards are small business cards.

Chase Ink Cash $300 (30,000 UR Points) Offer

– Chase Ink Cash $300 Application Link

The Chase Ink Cash is the no fee business card from Chase that rewards spending with cash back. Like the Chase Freedom card (see How To Unlock Your Chase Freedom Points), this cash back can be converted to full Ultimate Reward points if you have a card like the Chase Sapphire Preferred, Chase Ink Plus, or Chase Ink Bold.

For a sign-up bonus, $300 may not sound like much but there is a lot going for this card. First, the offer is up $100 from the normal bonus of $100. Second, this card comes with no annual fee. That means that you can stick it in your wallet (or in your drawer, but I will show you why you may not want to do that) and never pay an annual fee.

Though the bonus is worded as cash back, as long as you have one of the three Chase cards mentioned above, you are going to be 30,000 Ultimate Reward points richer!

Card Details

- Bonus offer of $300 after spending $3,000 in 90 days

- 5X points/cash back on the first $25,000 per account year at office supply stores and on cellular phone, landline, internet and cable TV services (the Ink Plus is up to $50,000 per year)

- 2X points/cash back on the first $25,000 per account year at gas stations and restaurants

- 1 point/% everywhere else

- No annual fee

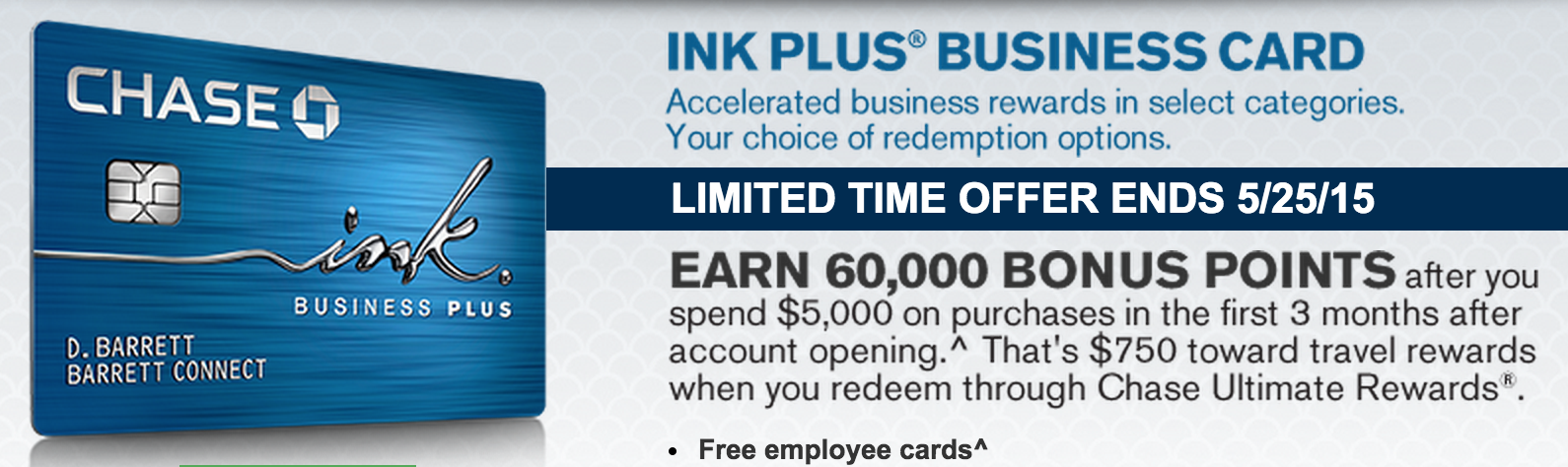

Chase Ink Plus 60,000 Point Offer

Chase Ink Plus Application Link – 60,000 Ultimate Reward Points after spending $5,000 in 90 days (I do not get a referral for this but if you would like to help another blogger, this link will take you to Frequent Miler’s page where you can apply through there.)

Along with the Chase Ink Cash bonus bump, we also see a bump from the Chase Ink Plus. The normal offer is 50,000 points after spending $5,000 in 90 days. With this limited time offer, that bonus has gone to 60,000 points for the same $5,000 spending in 90 days. The biggest difference between these offers (besides the increase in points) is the fact that the annual fee of $95 is not waived the first year. That means that the extra 10,000 points will actually cost you $95.

Now, you can easily get 10,000 Ultimate Reward points for less than $95 by buying prepaid gift cards at office supply stores (to earn the 5X points). However, if you do not want to go that route for either time or something else, I think it is a bargain to buy the points at less than a penny each with this increased offer. By transferring to partners like Hyatt, United, Southwest, and British Airways, I am easily able to get more than 1.5 cents per point in value.

You may be able to get the card offer without the annual fee. In the past, you could go to a Chase bank and sign-up and the annual fee would be waived. I would assume that would be the case this time as well. I think that is a better route to go.

Card Details

- Bonus offer of 60,000 after spending $5,000 in 90 days

- 5X points/cash back on the first $50,000 per account year at office supply stores and on cellular phone, landline, internet and cable TV services

- 2X points/cash back on the first $50,000 per account year at gas stations and restaurants

- 1 point/% everywhere else

- $95 (not waived)

Which Card Is Better?

I think, for a long-term card strategy, the Chase Ink Cash is the better card. There is no annual fee and the earning advantage is the same on both the Ink Cash and the Ink Plus. If you decide to keep the Ink Cash instead of the Ink Plus, just make sure that you have one of the big three Chase cards (Sapphire Preferred, Ink Plus, Ink Bold) to unlock your Ultimate Reward points earned with the Ink Cash.

However, there are two exceptions to that suggestion. The first is that the Chase Ink Cash does not waive the foreign transaction fees. That means that you will be on the hook for 3% on every foreign transaction. It may not mean much since there are so many other cards that waive it, but if you plan on using it for gas purchases outside of the US, it would be a negative (there are several cards that offer bonuses on gas stations that limit it to US stations – this card does not).

The other exception is if you actually go over the $25,000 per year in each of the bonus categories. If you buy and liquidate gift cards at office supply stores, it is not very difficult to spend $50,000 per account year on those purchases.