The normally mediocre offering on the United MileagePlus Explorer card has been raised significantly to 50,000 United miles (5,000 additional with the addition of an authorized user) for the next month. I wrote about it last week and it truly is a wonderful card and great bonus!

application link – United MileagePlus Explorer – 50,000 miles and $50 after $2,000 spent (I do not receive a commission for this card)

The Case for Everyday Use

But, what about using the card after meeting the $2,000 minimum spending? Most airline and hotel branded credit cards generally do not offer any great benefits to continue to use them after meeting the spending requirement. They are meant to compliment your loyalty account with the perks they offer (though the banks would prefer you continue using them!). They do not have any great category bonuses like other cards (like the Amex Premier Rewards Gold or the Chase Ink duo) and generally just offer 1 mile per dollar on everything that is not purchases from their branded carrier (in this case, airfare booked with United).

But, what about using the card after meeting the $2,000 minimum spending? Most airline and hotel branded credit cards generally do not offer any great benefits to continue to use them after meeting the spending requirement. They are meant to compliment your loyalty account with the perks they offer (though the banks would prefer you continue using them!). They do not have any great category bonuses like other cards (like the Amex Premier Rewards Gold or the Chase Ink duo) and generally just offer 1 mile per dollar on everything that is not purchases from their branded carrier (in this case, airfare booked with United).

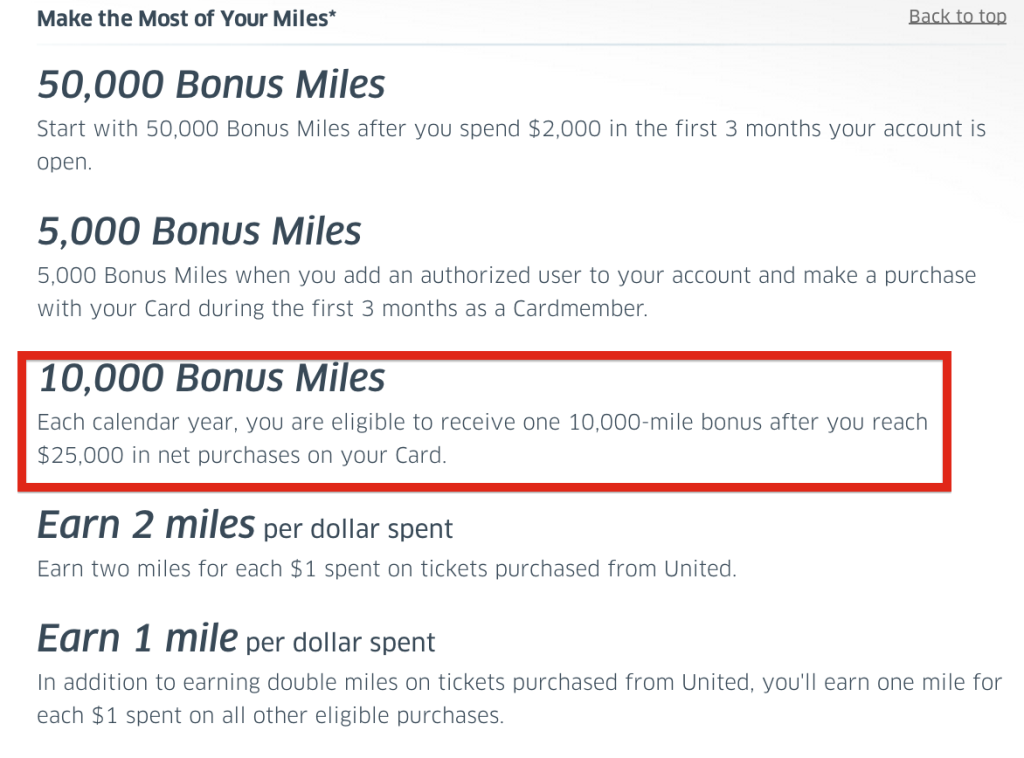

That does not mean that all cards are created equal, however! The United MileagePlus Explorer card has a strong benefit that does not get talked about that often and that is – the bonus of 10,000 miles after spending $25,000 in a calendar year. (to be fair, other co-branded credit cards may have similar threshold requirements, but they normally get talked about more)

Threshold Bonus

If you spend $25,000 in a calendar year on the United MileagePlus Explorer card, you will receive an extra 10,000 United miles. That is like getting 1.4 miles for every dollar spent (if you meet the $25,000 threshold)! The only card that does better than that for United miles is the United Club card that gives an automatic 1.5 miles on ever dollar spent (but carries a $395 annual fee).

Obviously, you need a plan to ensure that you will meet the $25,000 number or else you will have put a lot of money on that card without a lot of return. But, there are many ways that you can get that amount without going too far outside your normal scope of spending.

With Amazon Payments, you can pay friends/family up to $1,000 (total) each month for no fee x 12 months gives you $12,000 in spending just with that! With the additional $13,000, it breaks down to $250 in spending per week on the card. For most people, that would not be a problem.

Obviously, you would want to use other cards for categories that give you bonuses (like grocery stores, gas stations, travel, etc), but for everything else, the United MileagePlus Explorer card is an excellent candidate in order to hit that threshold.

United miles still have tremendous value. Our family uses them to go back and forth from Europe to the US and even flying in coach, the savings are extreme. The value would be even better if you can tack some stopovers on your trips or fly in business or first class. No matter what you do, getting 1.4 United miles per dollar spent is a great way to pad your United account.

Just make sure you just barely clear the $25,000 mark, though. The card’s value drops off after you meet that threshold so you would want to switch your spending to another card after you hit it. Plus, remember that the card does come with a $95 annual fee after the first year, but I normally did not have a problem getting a $100 statement credit or 10,000 United miles to keep the card open. Your chances of getting an offering like that would be even higher since you would be considered an important customer with spending $25,000 on that card. Also, if you are a United 1K, you will get a $60 statement credit towards your annual fee each year!

Side Benefit of the Threshold

Finally, there is one other benefit of meeting that threshold. United has instituted a system where they need to spend a certain amount of money on United tickets each year as well as qualify by flying to reach the different elite levels. The amounts required are not easy to reach for people who fly on the cheapest tickets. So, if you fly the 50,000 elite miles in a year that United Premier Gold requires but do not meet the spend of $5,000 spent on United tickets, then you will not have Gold status.

There is one way around that for United members who have US addresses – spending $25,000 in a year on a United co-branded credit card! So, by spending that amount of the card, not only do you get the 10,000 mile bonus, but you also earn a waiver on your elite qualifying dollars!

Summary

Obviously, this card may not be for everyone for an everyday card. But, if your goal is to collect United miles and you do not have a lot of different cards you do your spending on, this card could be the perfect fit if you can hit that spending threshold in a calendar year. For all but the bigger spenders, it might be hard to hit the amount this calendar year, but you can start on January 1st towards earning the bonus for next year!

Very insightful post, this card has been getting a lot of attention lately and I’m glad you provided some original insights. I really liked that the 25k spend counts towards elite qualifying dollars, this almost makes the case for attempting United status again.

[…] (adsbygoogle = window.adsbygoogle || []).push({});(adsbygoogle = window.adsbygoogle || []).push({}); The normally mediocre offering on the United MileagePlus Explorer card has been raised significantly to 50,000 United miles (5,000 additional with the addition of an authorized user) for the next month. I wrote about it last week and it truly is a wonderful card and great bonus! Read full article […]