Every year around this time over the last few, the Chase Ink cards see an increase in the sign-up bonus. What once used to be an annual occurrence is now a somewhat more frequent increase. This is already the 3rd time this year that we have seen this increased bonus. So, if you missed it the first few times, now is your chance.

Increased Offers: Chase Ink Plus 60K Points

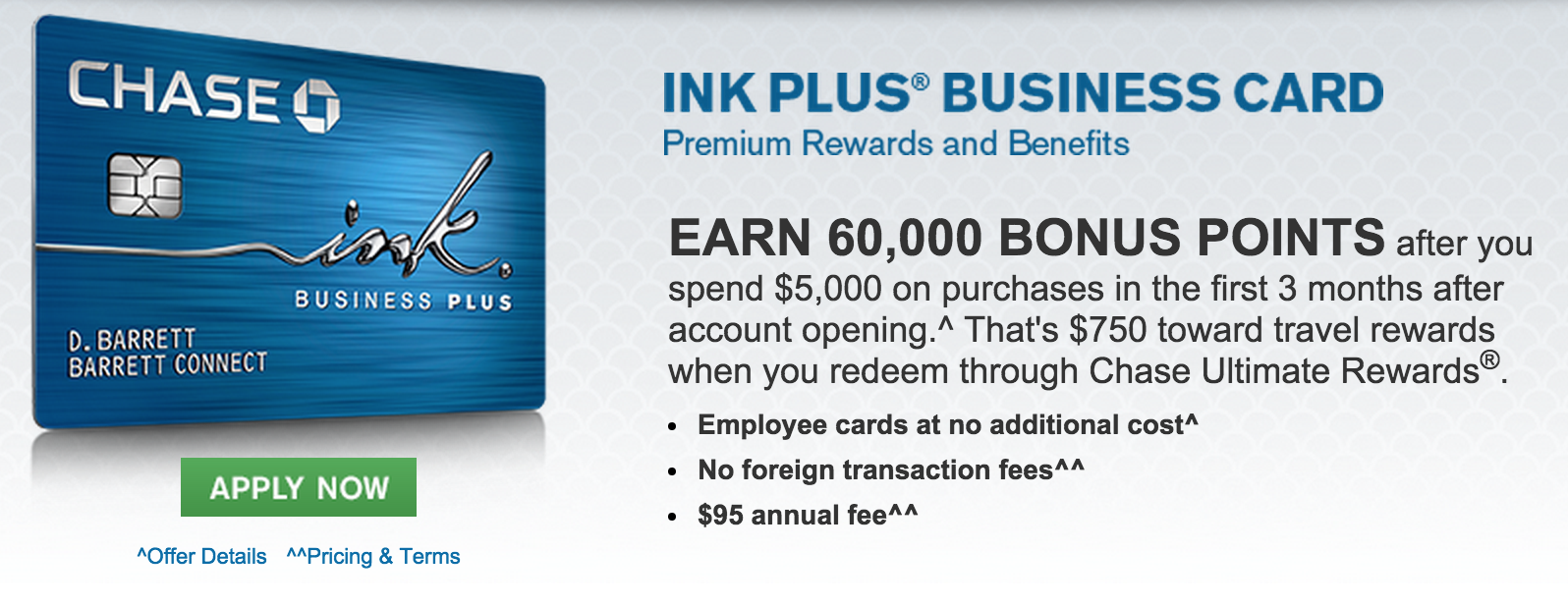

The Chase Ink Plus Offer – 60K Points

– chase ink plus application link

Now, when you apply for the Chase Ink Plus, you will receive 60,000 Ultimate Reward points after spending $5,000 in 3 months. The card comes with an annual fee of $95 if you apply online. In the past, if you apply in a Chase branch, the annual fee is waived. That should be the same this time around.

Chase Ink Plus Details

- 5x points per dollar spent at office supply stores, and cable, internet, landline, and wireless bills (up to the first $50,000 per year)

- 2x points per dollar spent on gas and hotel accommodations (up to the first $50,000 per year)

- 1 point per dollar spent on everything else with no limit on the points that can be earned

- The annual fee ($95) is not waived for the first year (unless you apply at a Chase branch)

- Ability to add employee cards with different numbers to protect the account and provide for easy sorting of transactions

- No foreign transaction fee (typically 3%)

What Can You Do With 60,000 Ultimate Reward Points?

There are a lot of things you can do with that many points! I will just cover some of them:

- Redeem for $750 in travel – if you want to, you can redeem those points through the Ultimate Rewards mall for travel at hotels, in airplanes, rental cars, and cruises for $750 in straight value

- Redeem for economy to Europe – If you transfer to United (1:1 transfer partner), you can get a round-trip award ticket to Europe in economy.

- Redeem for economy to southern South America – Again, transferring to United will get you enough for a round-trip to southern South America.

- Redeem for economy to the Caribbean or Central America – almost 2 round-trips! – That’s right! 2 roundtrips to those destinations will cost you 70,000 United miles. Once you factor in the minimum spend of $5,000, you will be 5,000 miles away from two tickets.

- Redeem for 13 one-way short-haul trips on US Airways or American Airlines – If you transfer to British Airways, you can redeem your Avios for 4,500 points on one-way short-haul (less than 650 miles) with US Airways or American Airlines. Great value here!

- Redeem for several nights at Hyatt hotels – You can transfer your points to Hyatt (another 1:1 partner) for multiple night stays at various Hyatts – 2 nights at a category 7, 3 nights at a category 5, and 5 nights at a category 3!

The Chase Ink Cash Offer – 30K Points

– Chase Ink Cash Application Link

The Chase Ink Cash is the no fee business card from Chase that rewards spending with cash back. Like the Chase Freedom card (see how to unlock your chase freedom points), this cash back can be converted to full Ultimate Reward points if you have a card like the Chase Sapphire Preferred, Chase Ink Plus, or Chase Ink Bold.

For a sign-up bonus, $300 may not sound like much but there is a lot going for this card. First, it is an increased offer which is always good! Second, this card comes with no annual fee. That means that you can stick it in your wallet (or in your drawer, but I will show you why you may not want to do that) and never pay an annual fee.

Though the bonus is worded as cash back, as long as you have one of the three Chase cards mentioned above, you are going to be 30,000 Ultimate Reward points richer!

Card Details

- Bonus offer of $300 after spending $3,000 in 90 days

- 5X points/cash back on the first $25,000 per account year at office supply stores and on cellular phone, landline, internet and cable TV services (the Ink Plus is up to $50,000 per year)

- 2X points/cash back on the first $25,000 per account year at gas stations and restaurants

- 1 point/% everywhere else

- No annual fee

Which Card Is Better?

I think, for a long-term card strategy, the Chase Ink Cash is the better card. There is no annual fee and the earning advantage is the same on both the Ink Cash and the Ink Plus. If you decide to keep the Ink Cash instead of the Ink Plus, just make sure that you have one of the big three Chase cards (Sapphire Preferred, Ink Plus, Ink Bold) to unlock your Ultimate Reward points earned with the Ink Cash.

However, there are two exceptions to that suggestion. The first is that the Chase Ink Cash does not waive the foreign transaction fees. That means that you will be on the hook for 3% on every foreign transaction. It may not mean much since there are so many other cards that waive it, but if you plan on using it for gas purchases outside of the US, it would be a negative (there are several cards that offer bonuses on gas stations that limit it to US stations – this card does not).

The other exception is if you actually go over the $25,000 per year in each of the bonus categories. If you buy and liquidate gift cards at office supply stores, it is not very difficult to spend $50,000 per account year on those purchases.

What Has Changed Since Last Time?

Since the last bonus was introduced, Chase has cracked down on those who apply for several cards. The Ultimate Reward earning cards have been declined to many people who have had 5 or more new card accounts in the last 2 years. That means if you are a regular card churner, you will not be able to get these cards.

This means that it will not be as easy for many people to get these increased offers as it was last time around. However, if you have fewer than 5 new cards (even those where you are an authorized user) from banks in the last 2 years, these are great offers to go for!

See this post for policies on churning cards and applying for new ones.

Possibly The New Normal Offers?

There is one more thing that has changed this time but I am not sure if this going to happen or not as of yet. Normally, when the increased offers pop up on these cards, there is a banner stipulating that it is a limited-time offer or it will give when the offer will expire.

This time, there is no such banner. That could mean that it might be the new offer. Chase has been bumping up their business cards to higher bonuses as of late as the standard offers. Since Chase charges the $95 fee on this increased offer for the Ink Plus, they are making $95 for offering 10,000 points which may be worth it to them.

HT: Dustin from Waller’s Wallet

FYI, I sent a secure message and chase will match my original 50K offer (signed up 2wks ago) with the new 60K offer. better yet, they didn’t say anything about the $95 fee, which isn’t waived in the new offer, but IS waved in the original 50K offer.